Stocks Advanced on Renewed Optimism

MFMTeam

Publish date: Wed, 16 Dec 2020, 10:13 AM

STATE OF THE MARKETS

Stocks advanced on renewed optimism. Global equities advanced higher on Tuesday as another vaccine candidates from Moderna was approved for deployment by the US FDA. This was on the back of bipartisan talk that another fiscal stimulus bill worth $748b would be enacted next week, as both Democrat and Republican agreed to press ahead with something rather than nothing. The renewed optimism saw the 10Y yield benchmark rose and closed above the 91 basis point with more than $227b worth of block orders flows into the US treasury.

Crude continue to climb higher to close around $47.62 but continue under selling pressure from speculators with block orders worth more than $65m exchanged hands around the $47.50/barrels. Gold advanced higher, closing above $1855.30, as investors hedge their bets against inflation with the devalued greenback. Dollars index (DXY) continue to fall below the 90.50 handle as Feds meet this week to discus its next monetary policy and investors are expecting more stimulus to help the economy. The seasonal bid for the Dollars seemed to have been lost as investors have more assets classes to diversify their portfolio.

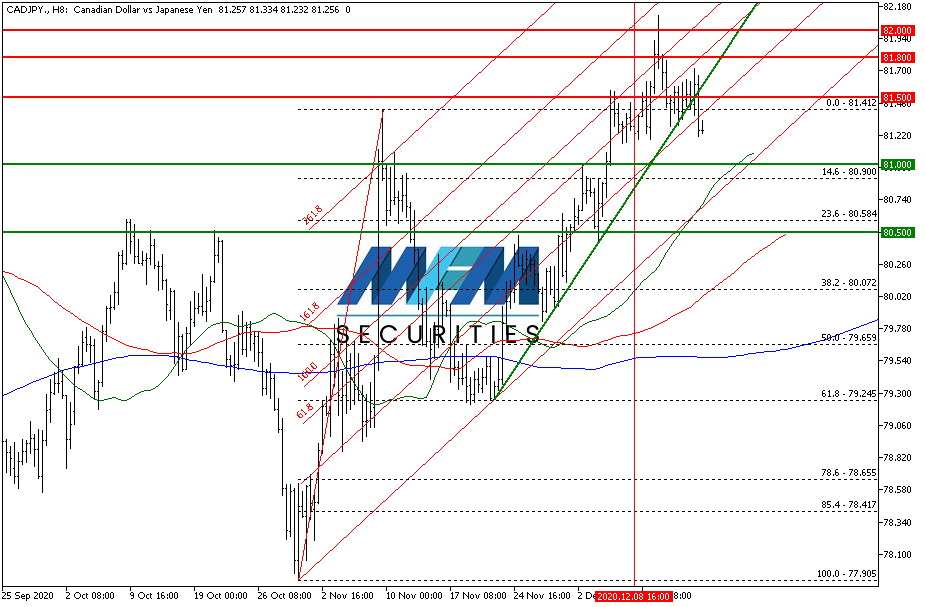

OUR PICK – CAD/JPY

Markets jitters are lurking. CNN Fear & Greed index was waning for the past 5 days and stalled at 69 yesterday with G8 sentiments driving Yen further in the demand seat for the medium term. On Dec 8th, we picked CAD/JPY but had to cut the losses short as the pair closed above 81.50 on the 10th. Yesterday, the pair closed back below 81.50 and recent CFTC speculative positioning remains bearish with $1.62b worth of CAD shorts and $5.78b worth of Yen longs. We re-entered the trade with new stop.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.