Mixed Equities As Feds Stands Still

MFMTeam

Publish date: Thu, 17 Dec 2020, 08:38 AM

STATE OF THE MARKETS

Mixed equities as Feds stands still. US equities finished mixed Wednesday, with Dow fell 45 points (-0.2%), S&P500 edged 7 points higher (+0.2%) and Nasdaq climbed 63 points (+0.5%) when the Federal Reserve kept its rate unchanged and vowed to support the economy until full employment is restored. Treasury yields moved higher on the news, with the 10Y benchmark reached as high as 0.96% before settled at 0.92%.

Crude continued its upward trajectory, to close above $47.80, running through all stops around $48.00/20 when EIA reported that US crude inventories was reduced by 3.1m barrels last Friday. Similarly, gold advanced higher, closing above $1864.10, as inflation become primary concern for 2021.

In the FX space, Dollar seemed supported by CAD in the short and medium term, albeit temporarily on year end profit taking. Yen retained lead in demand against the commodity CAD in all three horizons as CBOE put/call ratio increased, which signaled more safe-haven demand as evident in more inflows to bond than stocks. CNN fear and greed index stalled at 69.

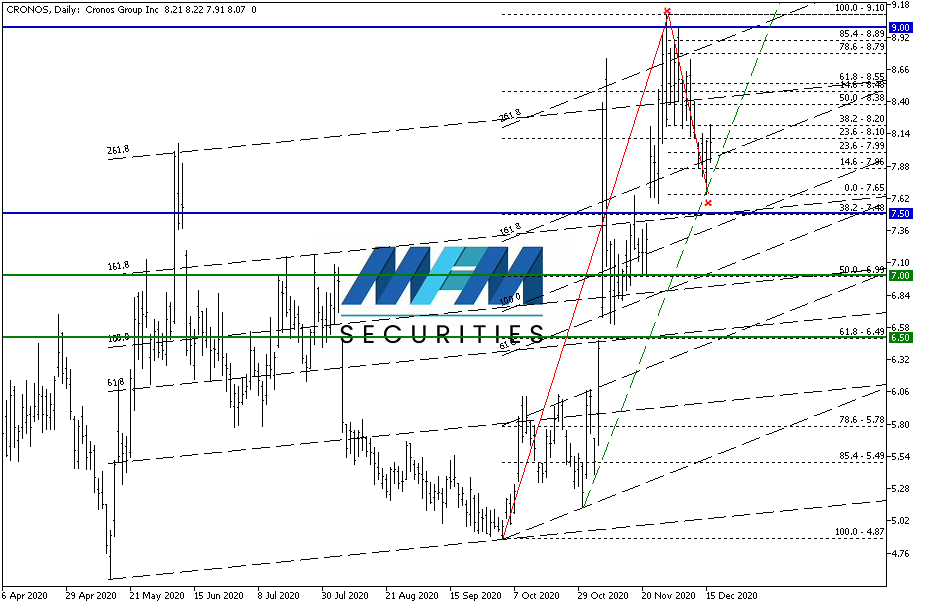

OUR PICK – Cronos Group (CRON, Nasdaq)

As Federal eases, weeds grow. Recent US House of Representatives’ decision to legalize marijuana at the federal level is a win to the cannabis industry and if passed by congress, would see cannabinoid stocks surging higher. With recent reports of earnings growth in Cronos, which made the stocks trading at 3.24 times earnings, it’s cheaper relative to its peers and S&P500. Now waiting for the vote in congress, the stock may have limited upside and pullbacks in the medium term as Republican controlled congress is unlikely to pass the bill. Long term however, as stigma around marijuana recedes, this stocks may climb back to it’s historic high of $25.10 in February 2019 when weeds stocks were the craze of investors.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.