Markets Mixed in Choppy Trading

MFMTeam

Publish date: Wed, 23 Dec 2020, 08:52 AM

STATE OF THE MARKETS

Markets mixed in choppy trading. US markets were trading in choppy waters Tuesday, when major equities traded lower together with gold and crude oil, while bond was trading higher; subsequently pushing yields lower. The Dow fell 200.94 points (-0.67%) and S&P500 downed 7.66 points (-0.21%) while the tech heavy Nasdaq was up 65.40 points (+0.51%). Flight to safety was seen as US 10Y yield moved lower, testing the 21 days MA around 0.91%.

Crude continued to move lower, closing below $46.50/barrel in a defensive move as traders prepare for a potential global lockdown. The anti-inflationary asset gold, was also seen lost bid, returning to the mid-term support of 55 days MA around $1,870/oz as President Trump refused to sign the US stimulus bill.

This supported the Greenback that has been clinging to the 90 mark since the new strains of corona virus hit the wires in early Asian trading Monday as evident in the short and medium terms demand. Investors seems to be less bullish about Brexit as demand for Sterling shifted lower in the medium and long term accounts. Long term support at November break-out may provide short term rebound.

OUR PICK – Tesla (TSLA, Nasdaq)

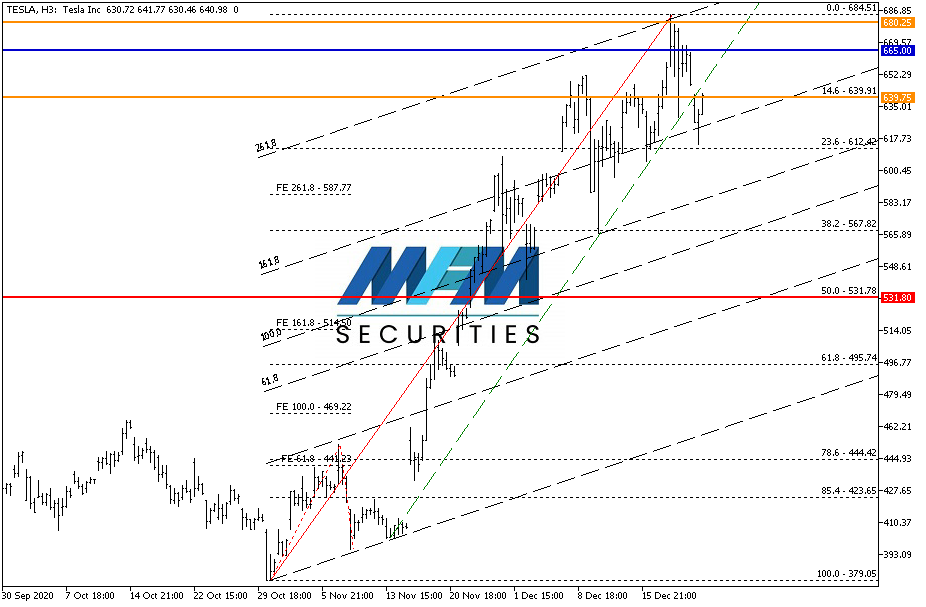

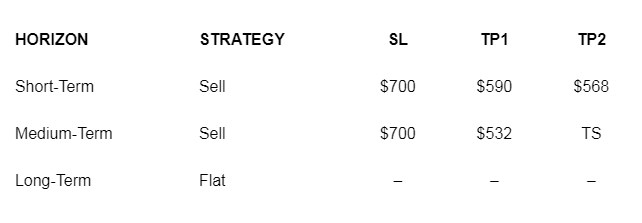

The new kid in EV space is Apple. Our attempt to short Tesla back in November was untimely as the share was still the craze of the millennials then. Now that Apple (AAPL) has dropped the bombshell that it’s moving forward with self-driving car technology and looking towards production in 2024 , we see that Tesla is poised for a correction. Fair value estimates from major research houses point to a significantly overvalued TSLA, with an expected mean reversion of around 30%, circa $450. Last few days had seen heavy profit taking from insiders, pressuring the stocks lower with 21 days VPOC of $639.75 and 8 days VPOC of $680.25. $665 is the weekly pivot and we look forward to seeing the share testing the 50% retracement of October low to December high, circa $531.80 in the next 3 months with trailing stop (TS). Sell on rally and cut the losses short if daily closed above $665 with hard stop at $700.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.