Equities Surged on Fiscal & Vaccine News

MFMTeam

Publish date: Tue, 29 Dec 2020, 09:00 AM

STATE OF THE MARKETS

Equities surged on fiscal and vaccine news. Global equities mostly closed higher Monday on the news of US fiscal stimulus being signed into law and AstraZeneca’s covid-19 vaccine being approved by the UK authorities as early as this week. Cheering the news was also the Japanese Nikkei, hitting 30 year high in Tuesday Asian trading. Bond yields were mostly unchanged and flat as markets opened post Christmas holiday.

Crude retreated lower closing below $47.65 as long term players initiated profit taking for year end book closing, while gold rose as high as $1,900.53 before settled lower, below $1,871.20 as market brace the news of another vaccine candidate from AstraZeneca; which benefitted the Greenback.

Dollar index (DXY) saw firm support around the 90 handle with bidder’s short covering to close above 90.27 as New York closed, though early Asian trading Tuesday, saw a gap down as market digested the new stimulus spending. Dollar took the lead in the short term on short covering and Kiwi had flipped on the medium and long term while Aussie is relatively unchanged. The days of profit taking for FX traders are here.

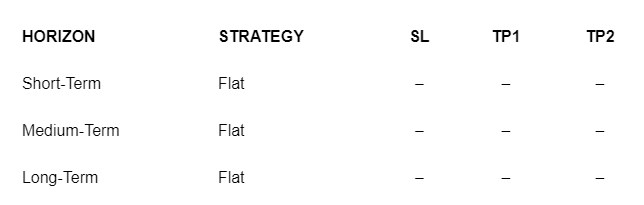

OUR PICK – No New Pick

No new pick for the year end due to thin markets. Year end is the time to reflect upon our performances and what have we done well and what could have been better. How good have we been in following our processes and procedures in the trading plan. Have we able to achieve our yearly goals with the plan. How has the markets changed for the past 12 months and how well we navigated those changes. Anything new that need to be incorporated into the plan if markets dynamics have changed. These are all questions we have for ourselves and we believe you should ask yourselves too. Happy holidays and may the coming New Year bring you greater joy and fulfillment.