Equities Tumbled on Virus & Political Concerns

MFMTeam

Publish date: Tue, 05 Jan 2021, 08:54 AM

STATE OF THE MARKETS

Equities tumbled on virus and political concerns. US equities traded lower on the first trading day of the new year as corona virus continues to take its toll and vaccine seemed to have a slower roll-out than expected. Adding to the concern is Georgia election that will decide the control for US senate that may see Democrat returns which could see markets moving lower on increase corporate tax rate. US 10Y yield remain unchanged at around 92 basis points.

Crude declined sharply, closed below $47.65/bl, as Russia hinted at production hike that may see increased supply as markets barely balance itself after demand flattered during the pandemic. Gold rallied, closed above $1,942.25/oz, as markets factored the possibility of the Democrat controlled senate that would see more stimulus for the US economy.

The greenback traded lower, below the 89.40 level, before bidders emerged to closed the deal around 89.85 with Euro, Yen and Swiss in the short-term. Medium and long-term accounts seemed synchronized in demand as investors rebalance their portfolio for the new year.

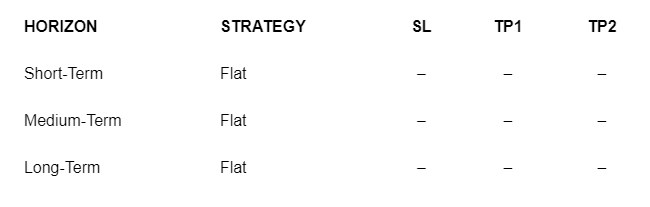

OUR PICK – No New Pick

No new pick for first week of the new year due to thin markets. First week of the new year is the usual time to rebalance the portfolio and readjust our trading system and strategies to reflect new market dynamics. We will wait until after the release of US employment figure for December before making any new pick.

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.