Earnings Season Started to Drive Stocks Higher

MFMTeam

Publish date: Wed, 13 Jan 2021, 08:54 AM

STATE OF THE MARKETS

Earnings Season Started to Drive Stocks Higher. US major indexes edged higher Tuesday, amid earnings seasons that will mark corporate earnings performance post lockdowns. Investors are paying attention especially to the financial sectors that will have the like of Chase, BlackRock, Wells Fargo and Citigroup reporting on Friday. In the mean time, more than $750b flowed into the US treasuries, as yields for 10Y closed for 1.13% and the shorter 5Y closed for 0.5%

Crude continued its upward trajectory as concerns for short-term demand were rebalanced with Saudi Arabia pledge to cut supply as well as China optimism and the expectations for the weekly EIA supplies to fall. The black gold closed above $53.20/bl for the first time in 11 months. Gold saw firm bid in the $1,850 levels as investors concerns for inflation bolstered demand for the yellow metal.

In the FX space, Dollar demand lost its lead in the short-term while retreated by two notches in the medium term as yields point support in the interim especially from negative yielding Swiss in the long term. Investors were most bullish in Sterling though recent narratives did not bode well for the Queen currency.

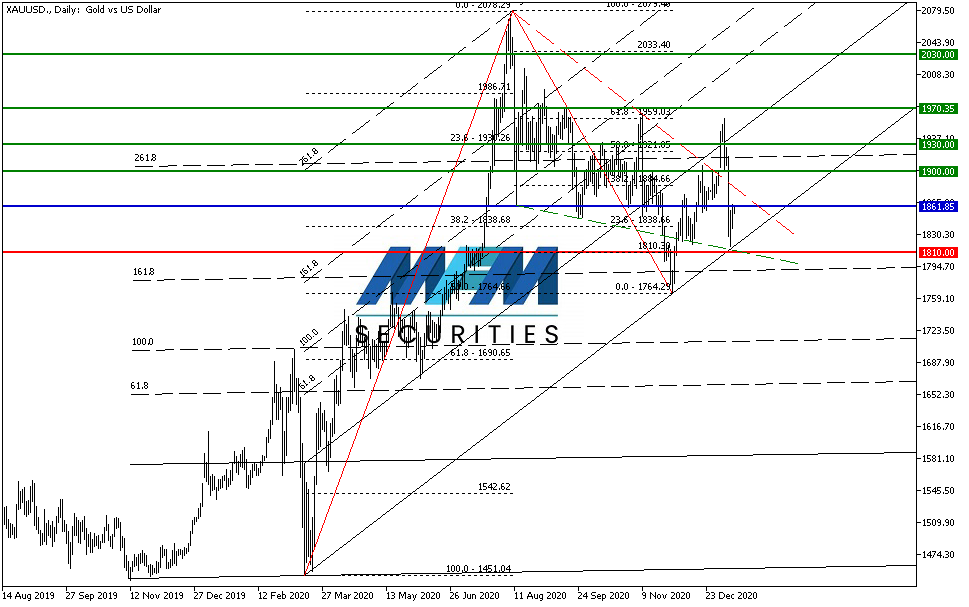

OUR PICK – XAU/USD

Rising Inflation Will Drive Gold Higher. History shows that the anti-inflationary asset precious metal, will always rise with rising inflation. Unprecedented monetary stimulus from the US Federal Reserve has driven assets prices higher especially the stock markets and real estate. Consumer goods have not feel the effects that much as most of the money were spent on investments. Gold, due to price fixing, has not reflect its true value; but we believe any dips is an opportunity to buy, especially when religious festivals would bolster demand for the yellow metal. We believe recent drop has bottomed out and prefer buy on dip with $1,810 stop as price struggled to break convergence of daily ($1,848.00), weekly (1,875.25) and monthly (1,861.85) pivot. Above $1,880 should clear the path to initial target $1,900.00

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.