Markets Mixed Amid Stimulus Hope

MFMTeam

Publish date: Tue, 26 Jan 2021, 08:25 AM

STATE OF THE MARKETS

Markets mixed amid stimulus hope. Global stocks closed mixed Monday as investors await the US Senate’s approval for the new stimulus plan worth $1.9 trillion to stimulate the US economy. European stoxx (-1.20%), FTSE UK (-0.84%) and Dow (-0.12%) were down while S&P and Nasdaq were up 0.36% and 0.69% respectively. Markets worries sent more than $700 billion into the US treasuries forcing the US 10Y benchmark to drop more than 70 basis points, but remains above the 1% mark. Hang Seng (-1.22%) and Nikkei (-0.78%) were also down in afternoon Asian trading on Tuesday.

Crude edged higher above $52.75/bl though offers remain elevated as demand worries capped further bid. The plan to kick start the world’s largest economy would benefit fuel consumption, but at this point, that is still pending Senate’s approval. Gold slid lower but remain on firm bid above the $1,850/oz as investors see rising inflation from the easy flow of money.

G8 currencies sentiments showed that Dollar remain bid in the short and long term as investors flight to safe-haven currencies dominate the FX space. Sterling and Euro seemed to lost ground as BoE said that the UK economy last year could be the biggest slump in 300 years. Aussie and Kiwi still lead the demand, but growing fears of market bubbles might send them to the back burner on a flip.

OUR PICK – AT&T (T, NYSE)

A watch on the earnings. AT&T is an old American company with sagging management. Not a darling of Wall Street as the CEO’s compensation continue to increase more than 20% despite the fact that the company’s earnings have fallen more than 20%. Nevertheless, it’s a good dividend pay master with 7.15% at current price compared to 5.7% industry average with 3 years earnings’ coverage. Earnings have been sliding for the past three quarters and this Wednesday will be a testimony whether the company benefits from the corona pandemic. Recent deals with Time Warner media hopefully will take future earnings to greater heights.

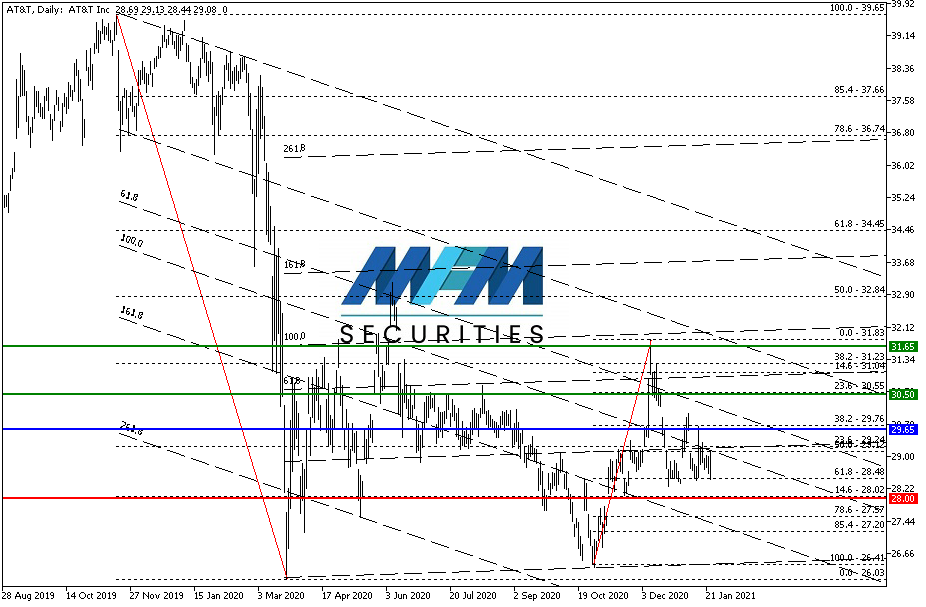

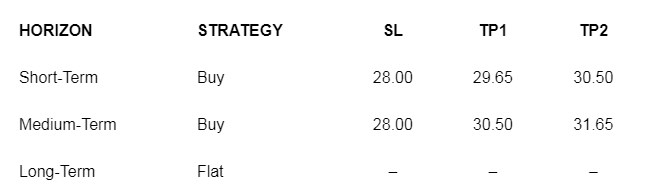

Technically the stock seemed to have formed a base around $29.00 in Q4, 2020. Bullish hammer on Monday signaled reversal to the upside. We favor long with $28.00 stop and cut losses short if price closed below $28.50 on the daily. At this point, we do not favor long term holding until the Time Warner deal has material impact on company’s earnings.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.