Equities Slipped While Waiting For Feds

MFMTeam

Publish date: Wed, 27 Jan 2021, 08:27 AM

STATE OF THE MARKETS

Equities slipped while waiting for Feds. US equities slipped lower on Tuesday as players awaits Federal Reserve policy decision on Wednesday. Dow, Nasdaq, S&P and even Russel, all slipped lower on profit taking led by energy and health care sectors; while consumer staples and real estates made a rebound on bargain hunting. Safe haven flows are increasing as optimism waned on the full amount of the new stimulus bill that would be approved by the US Senate. The benchmark US 10Y yield relatively flat, holding ground above the 100 basis points.

Crude remain under selling pressure, closed around $52.60/bl, as investors weigh the vaccine effects and the stimulus impact on fuel demand. New variants of the virus is leading to market concerns that may see the black gold remain on offers. The yellow metal gold, on the other hand, remain on firm bid at $1,850/oz as markets await Feds reaction to rising inflation concerns.

In the FX space, high likelihood of new stimulus bill being passed by the US senate has dampened demand for the greenback. The Dollar index (DXY) closed below 90.20 mark and seemed to be losing bid across the board. Aussie, Kiwi, Sterling, and Loonie took the helm of demand, while Euro remain depressed as the Italian political drama come to the limelight. PM Conte’s resignation offer, after losing his senate majority would force the Italians to go to polls and delay economic recovery.

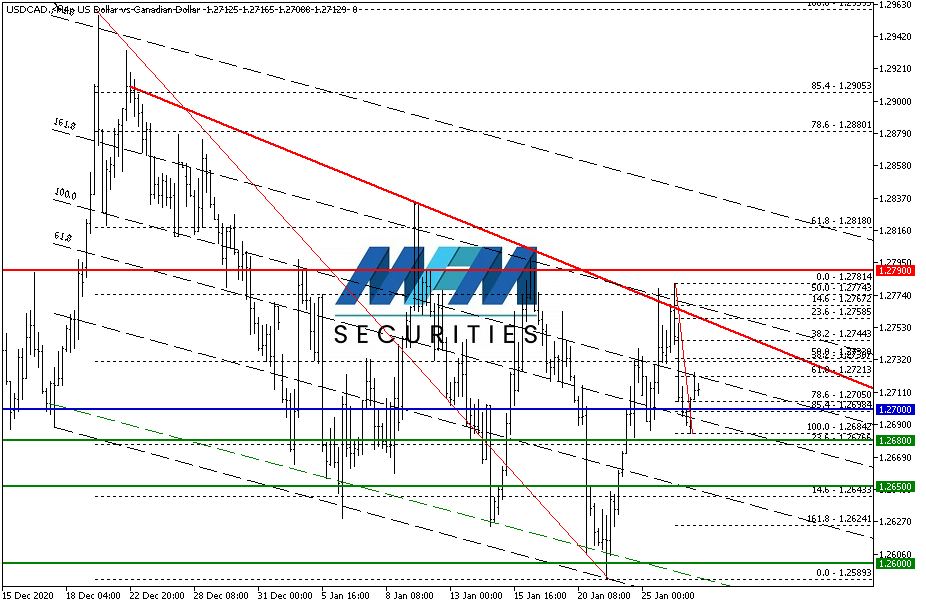

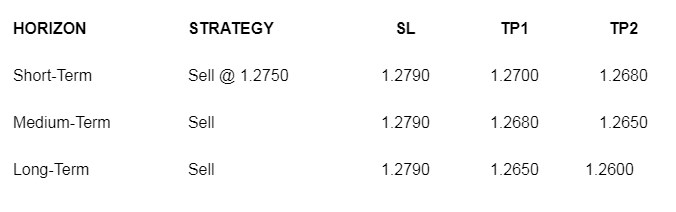

OUR PICK – USD/CAD

Dollar weakness to continue on Feds and stimulus. This trade idea came from bigpippin of babypips in his recent post. (Read here). The trade worked as plan and we do see further weakness in the pair as Feds most likely stand dovish on Wednesday, plus further stimulus approval from the US senate. There is two way at least to execute this trade in our opinion. 1. Sell on rally with 1.2790 stop loss as long as the exchange rate remain below the red downtrend line. We expect 1.2750 to hold. 2. Sell stop @ 1.2680 with 1.2750 stop loss and target accordingly to to balance your risk/reward ratio. Always trade within your risk limit. Good luck!

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.