Heavy Liquidation Forced Dollar Higher

MFMTeam

Publish date: Tue, 02 Feb 2021, 08:34 AM

STATE OF THE MARKETS

Heavy liquidation forced Dollar higher. The Greenback rebounded on Monday as demand increased from heavy liquidation in the US equities markets as 7.9 billion shares exchanged hands in the Nasdaq & NYSE. Long term players were seen to use the rebound in Dow (229 points), Nasdaq (333 points) and S&P500 (60 points) to cash in their investments sheltering profits. No block orders in US treasuries were seen as prices fell, forcing yields to go up, with the 10Y benchmark yielded 1.08% as markets closed.

Crude surged higher, closed above $53.50/bl as supplies decreased and demand increased from the worst winter in US northeast. Speculators, however, were seen shorting the black gold with more than $139 million worth of block orders. Gold following the lead, reached as high as $1,871.80/oz, before settled lower around $1,860.15 as Dollar strength capped the yellow metal upside.

King Dollar continues to lead as safe-haven flows remain to dominate the FX markets. The interest bearing reserved currency is a more preferred than the safe-haven Swiss and Yen, as long term outlook remains bullish. Trading in the commodity complex, remain choppy, as trader awaits the senate approval’s of the new US stimulus plan.

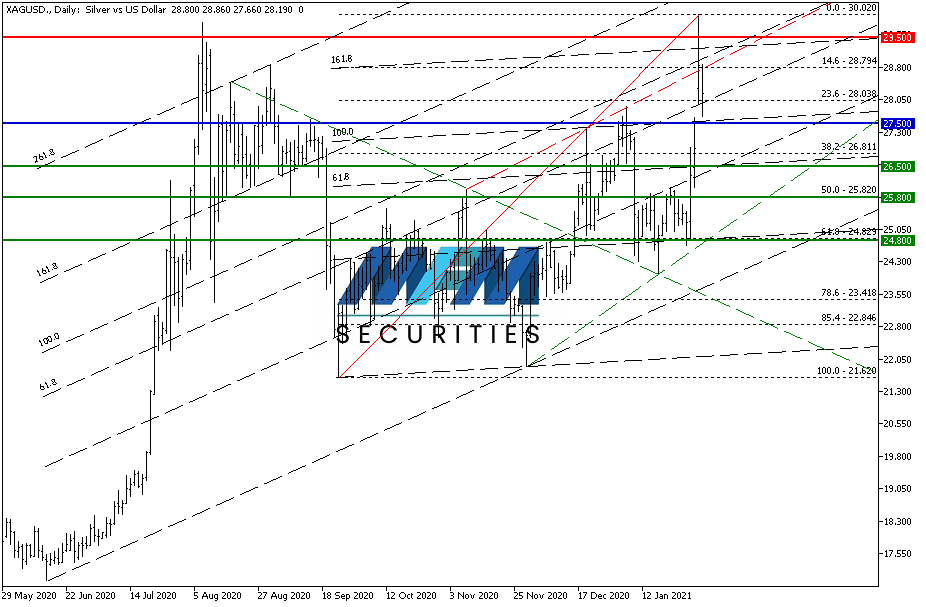

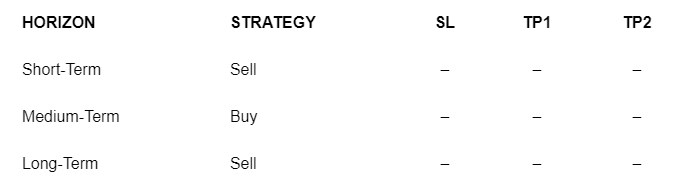

OUR PICK – XAG/USD

We are monitoring the spikes in Silver. The spikes in silver on Monday morning caught everyone’s attention including ours. The talk about short squeeze in silver from retail investors was kind of funny and didn’t make sense as large speculators net positions are about 33% long. So there is no short-squeeze but rather dealers asking for higher price as demand increased.

On another note, we see the heavy liquidation in the equities markets with investors preferring cash; is driving Dollar and bond yields higher, capping the rise in anti-inflationary assets like gold and silver. Until US senate’s approval of the new stimulus plan is confirmed, we see Dollar remains supported. It’s going to be a choppy first quarter, with unusual volatility; so we remain on the sideline for now until better risk/reward opportunity emerged. Stay tune.

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.