Markets Mixed Amid Stimulus Uncertainty

MFMTeam

Publish date: Thu, 04 Feb 2021, 08:51 AM

STATE OF THE MARKETS

Markets mixed amid stimulus uncertainty. Global markets closed Wednesday in a mixed tone as the world’s largest economy was still uncertain on the amount of stimulus spending needed to reflate the economy. While the Dow and S&P rose more than 0.10%, Nasdaq fell 0.02% with the FTSE UK (-0.14%) before Asian equities took a dip in early Thursday trading after reports of rising China short-term interest rate hit the markets. Liquidity concerns may trigger further safe-haven flow as Europe open later today. The US 10Y benchmark climbed higher to closed at 1.14%.

Crude climbed further up, closed above $55.65/bl after EIA reports showed that US supplies fell to the lowest level since March last year, at the peak of the pandemic. Gold dipped further as the stimulus uncertainty looms that give support to the Greenback. The yellow metal, closed below $1,833.80 before diving further in Thursday trading; which saw Dollar index holding strong above the 91.00 mark.

Earlier as New York closed, King Dollar took a retreat as the comdolls returned to demand across the short and medium term accounts. Sterling took a dive as short and medium term accounts took profit, while long term investors continue to accumulate the Queen’s currency. Swiss and Yen retreats across the board suggested that markets remain optimistic for now.

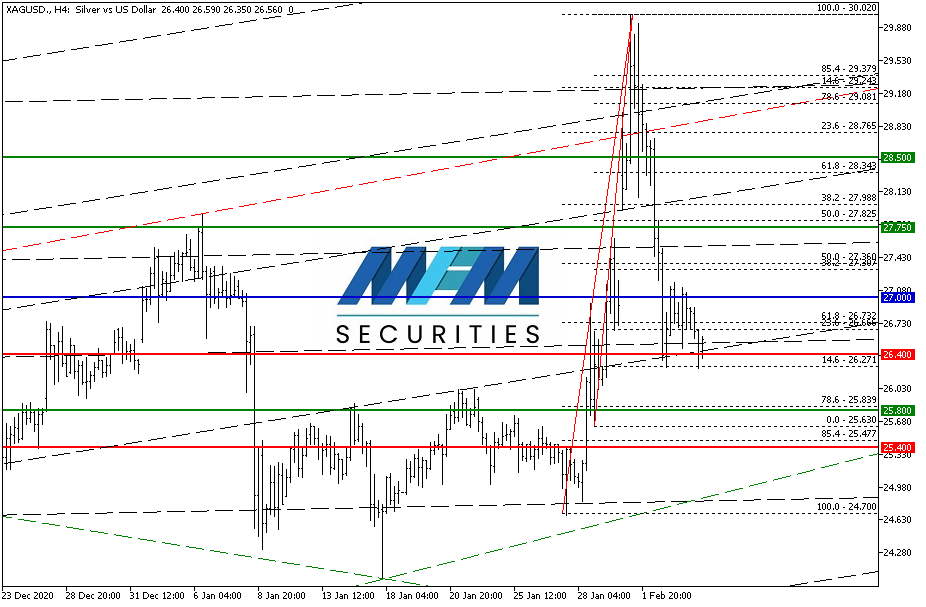

OUR PICK – XAG/USD

Dollar being repriced as stimulus uncertainty looms. When markets were confident that the Biden administration was going to go ahead with the big $1.9 trillion stimulus, Dollar was ditched as inflation concerns support the precious metals complex. Now that the amount is uncertain, markets are repricing the Dollar and precious metal took a dip as we had expected on Monday with Silver. At this juncture, there is still a risk that the metal could dive further to test $26-$25.80/oz as the uncertainties remain. However, we expect the metal to rebound once the amount is confirmed in the medium term. Day trader may still short with $27.25 stop and $26.00 – $25.80 limit.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.