Dollar Retreated on New Supply

MFMTeam

Publish date: Tue, 09 Feb 2021, 08:47 AM

STATE OF THE MARKETS

Dollar retreated on new supply. US equities climbed to record high on Monday after confirmation of stimulus amount as weak employment number last week prompted Treasury Secretary Janet Yellen’s comments on US ability to return to full employment. US treasury is ready to release new Dollar supply this week, in the total amount of $126 billion, which subsequently weaken the Dollar as yields went flat. Safe-haven flows remain stable as we observed and some parts of the markets remain cautious as equities climbed to record levels.

Crude climbed to the highest in 13 months, above $58.50/bl as of this writing, as optimism remain high that vaccine rollout will be able to speed economic recovery and fuel demand for the black gold, though upside seemed limited as price approach the technical resistance of $58.50. Gold thrived on Dollar weakness, closed above $1,830.15/oz after two weeks of being battered down by stronger Dollar. Rising yields however, may cap the precious metal upside in the medium term.

In the FX space, cautious play was evident as Dollar remain in demand for the short term, though medium term saw a sell off as markets priced the new supply. The comdolls were the primary beneficiaries, along side Sterling, of the Dollar weakness. Euro remain depressed as it rebounds and speculators were seen shorting the one union currency in block orders worth more than $170 million in Asian trading. At this point, markets look optimistic as Swiss and Yen remain offered.

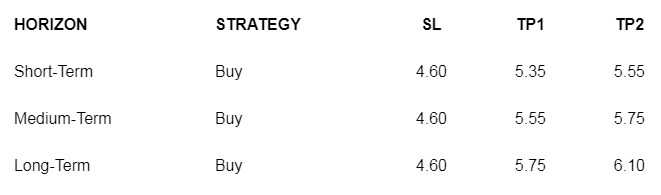

OUR PICK – Follow up on Yamana Gold (AUY, NYSE)

We believe Yamana has bottomed out. Late November last year, we pointed to the buy-on-dip strategy that was playing out in Yamana Gold (AUY) as long term players accumulate the shares. Heavy bid were seen last two weeks as price reached $4.50 and we believe it has found a bottom as shares exchanged hands. The company is expected to report earnings of $0.10/share this Thursday after paying three cents of dividend in mid January. Fair value estimates with 10Y DCF is around $10.00 and analysts consensus is a buy with average price target of $7.44. Long term investors may want to use an open take profit strategy with trailing stop to maximize return.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.