Mixed Equities Amid Safe-Haven Flows

MFMTeam

Publish date: Wed, 10 Feb 2021, 08:39 AM

STATE OF THE MARKETS

Mixed equities amid safe-haven flows. US equities closed mixed on Tuesday, with Dow (-0.03%) and S&P (-0.11%) edged lower, while the tech heavy Nasdaq (+0.14%) climbed higher. Communication, financial and industrial led the gains while energy, IT and materials lagged behind. Longer dated bonds were seen in demand earlier today as investors rotated to safer assets as Trump impeachment proceedings kicked start in the US senate. 10Y Yields were relatively flat around 1.16% which could kicked investors into Dollar buying again.

Crude had a joyride as profit taking dominated markets, with prices fell to around $57.25/bl before bidders came in to settled price higher around $58.35/bl. Investors confidence was on the high that economic recovery is on the way but caution on inflation has forced gold to as high as $1,849.15/oz before settled lower around $1,837.05/oz. Safe-haven flows was also observed in the FX market, albeit short-term.

Swiss, Yen and Euro took the helm of demand in the short-term accounts as Dollar plunged to the back burner with the Comdolls. Euro remains depressed in the long term, despite recent rally in the short and medium term accounts; while Sterling continues to advance. General sentiments remain optimistic as the Comdolls were on bid over the Greenback.

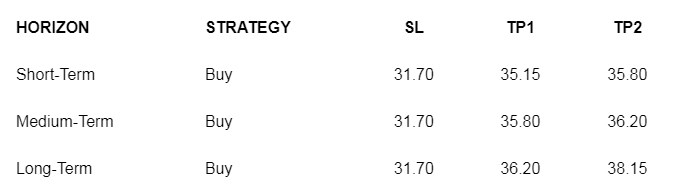

OUR PICK – KROGER (KR, NYSE)

Dividend, Dividend, Dividend. Mid November last year, we pointed to Kroger (KR) as markets were gearing for holidays. The stock was recently on short squeeze and has traded higher far reaching our take profit. Now we see demand sustained as income investors bid the stocks prior to the ex-dividend date on Thursday (11/2/2021). The annualized yield is 2.16% at current price, with $0.18/share paid on March 1, 2021. Fair value estimates with 10Y DCF is around $80.20 and analysts consensus is a buy with average price target of $34.80. 24 months beta is 0.25 so the stock is an obvious laggard. Long term investors may want to use an open take profit strategy with trailing stop to maximize return.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.