Safe Haven Flows Continue

MFMTeam

Publish date: Thu, 11 Feb 2021, 08:59 AM

STATE OF THE MARKETS

Safe-haven flows continue. US equities closed mixed again on Wednesday, with Nasdaq (-0.25%) and S&P (-0.03%) drifted lower, while the Dow (+0.20%) climbed higher. Majority of the sectors lost bidders, except for communication, energy and materials that remain supported. Assets rotation is in play and safe haven flows continue with cross border capital flow. US treasuries remain bid with more than $130 billion flowed in the futures market as yields drifted lower.

Crude continues to consolidate as it approached the $60.00/bl mark, with no clear resistance from sellers at this point as market optimism remains. The same can be said with gold that trades within a narrow band of $1,855.50 to $1,833.80 today as markets gauged earnings and economic data.

In the FX space, the demand for safe-haven Swiss has penetrated the medium and long term accounts as investors continue to take precaution of the elevated valuation of equities markets. The Comdolls continue to be in the back burner, except in the long term; and rising demand in the greenback for the short term indicated that traders and investors are ready for a risk-off play.

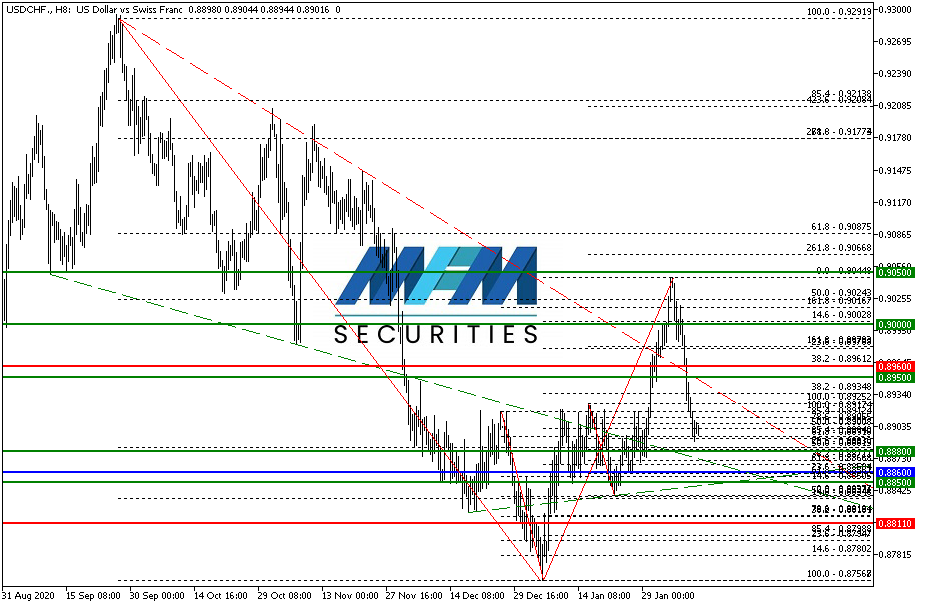

OUR PICK – USD/CHF

Playing the safe-haven battle again. Earlier in mid-Januari, we pointed to USD/CHF as markets were mixed on hedging. At this juncture, we observed the theme of assets rotation and hedging have been playing for quite some time as the risk of elevated valuation of the equities markets concerned many conservative investors. Though speculative options market showed no clear resistance to the upside, players have been very cautious to take further risk and rather bid small and mid cap stocks as we have seen for the past few weeks. We expect this trend to continue as long as the new stimulus plan is held at bay. Once released, we may see further rise in USD/CHF as optimism is kicked into higher gear. Short term risk is still to the downside.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.