Dollar Surged on Strong Retail Data

MFMTeam

Publish date: Thu, 18 Feb 2021, 08:54 AM

STATE OF THE MARKETS

Dollar surged on strong retail data. Dollar index surged past the 91.00 mark Wednesday, after US retail sales for January increased 4.2% more than what markets expected (1.1%); prompted a sudden drop in the equities market before bidders were seen in afternoon trading. Both Nasdaq (-0.58%) and S&P500 (-0.03%) closed lower while Dow (+0.29%) edged higher, after bond markets sell-off triggered rising yield past 1.33% for the 10Y bond.

Cautious investors speculated that with stronger than expected data, Feds may have to raise rate sooner than expected. This concerns was reflected in stronger oil prices as markets expect speedier economic recovery though crude that jumped past $61.00/bl was also fueled by the supplies disruption as record cold winter hit US refineries. Gold fell further to close below $1,780.00/oz after London fix pressed the yellow metal lower.

In the FX space, Feds tapering concerns prompted brief risk-off as Yen was heavily bid in the short term accounts. Demand for the Greenback and Comdolls remain steady across the board, as Sterling retreated in the short and medium term accounts. Euro saw heavy bidding through the Swiss exchange as London closed and steady bid at the ¥127.50 handle in Tokyo.

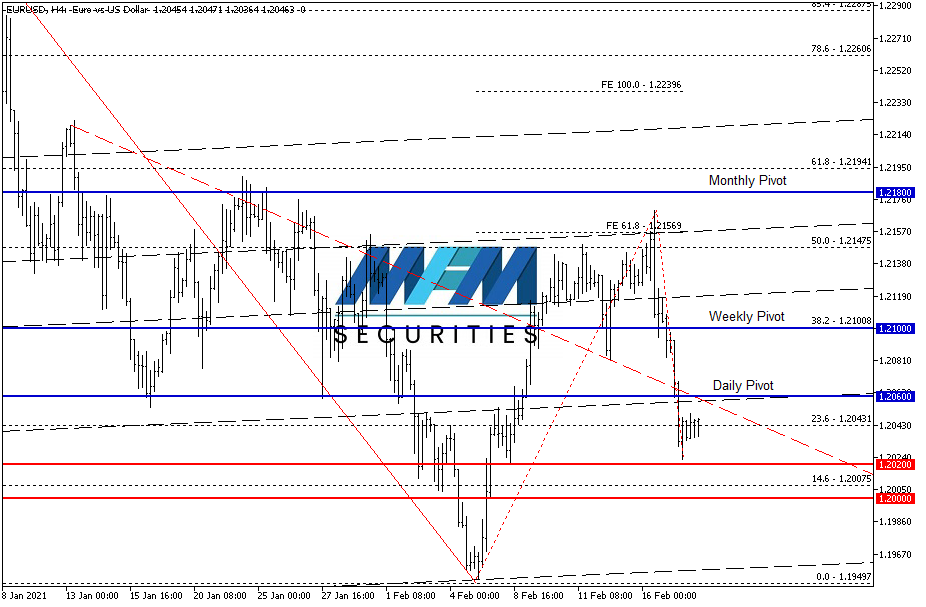

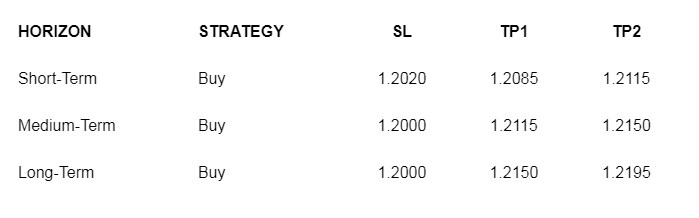

OUR PICK – EUR/USD

Medium to long term flows pointed to higher Euro. Yesterday was the inflection point for Euro as the one union currency fell for five straight weeks on Dollar short covering. It tried to stage a rally last week and the last couple of days pointed to a pullback as Dollar regained strength. Tuesday sentiments showed EUR/USD warranted a long but Wednesday was a sell. Right now markets is trying to find direction and order flows pointed to increased spreads in the 1.2020 to 1.2050 region, which means that dealers are bidding higher. The earlier than expected Feds tapering is very unlikely in our opinion. After all, the $1.9T stimulus is still on the way. Low risk short term trade at 1.2020 stop and a re-entry shall it reached 1.2000 handle. We may use trailing stop with open take profit to maximize returns.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.