Safe Haven Flows As Optimism Waned

MFMTeam

Publish date: Fri, 19 Feb 2021, 08:25 AM

STATE OF THE MARKETS

Safe haven flows as optimism waned. Global equities closed lower Thursday amid worries about rising inflation that would prompt central banks to hike earlier than expected. Dow (-0.38%), FTSE (-1.40%), Nikkei (-0.72%) drifted lower as player took profit and seek safe haven. Gold, Swiss and US Bonds saw inflows of more than $500 billion, with shorter dated maturity being preferred.

Crude futures gapped down Friday after settled around $60.50/bl on Thursday amid profit taking from long term players as Texas refineries went back online. Gold, on the other hand, dipped below $1,780/oz in early Friday trading after more than $76 million of block order failed to resuscitate demand.

In the FX space, the safe haven flows benefitted Swiss, after Yen retreated in the short term, and Dollar in the medium and long term accounts. Demand for the Comdolls receded across the board after Sterling regained the helm of demand. Euro saw steady and increased flow especially in the short-term while Loonie took a hit in the aftermath of oil’s retreat.

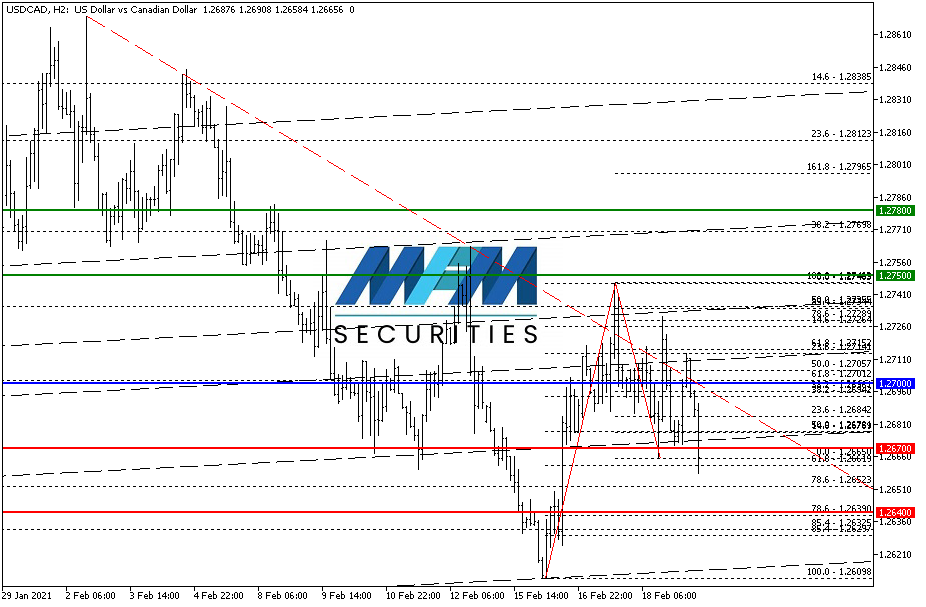

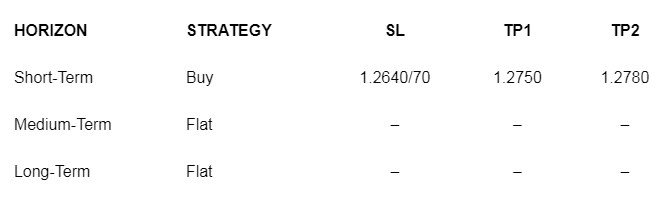

OUR PICK – USD/CAD

Safe haven flows would send USD/CAD higher. At this point we are just not sure whether this safe-haven flows would continue or it’s just a fling as US $1.9T stimulus is still on the way. So most likely it’s just repositioning and hedging on Dollar short covering in our opinion. Either way, in the short term at the very least, we would see USD/CAD rise if and only if 1.2650 is being defended. So there is two way to play this. The safe way is to buy stop @ 1.2700 with 1.2670 stop. Buy at market with 1.2640 stop is the alternative. We target 1.2750 and 1.2780 in extension. GOD willing, trades updates will come Monday. Till then, be safe and have a great weekend.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.