Stocks Mixed Amid Rising Yields

MFMTeam

Publish date: Tue, 23 Feb 2021, 08:42 AM

STATE OF THE MARKETS

Stocks mixed amid rising yields. US stocks closed mixed on Monday with tech heavy Nasdaq lost 2.46% and S&P down 0.77% while Dow was up 0.09% on upbeat Disney and movie stocks. On the other hands, concerns about earlier than expected rate hike, prompted more bond sell-off that pushed yields further up. The US 10Y benchmark spiked to as high as 1.394% before settled lower around 1.369%.

Crude continued its upward trajectory above the $62.50/bl, as US refineries still struggled to bring output back to normal after the deep freeze last week. OPEC+ meeting is due early March, where producers agreed to ease on supply after price hit $60/bl. Concerns over inflation has seen gold demand returned to above the $1,800/oz level as Dollar lost support after US house budget panel approved the $1.9 trillion COVID-19 aid bill.

The prime beneficiaries were Aussie, Kiwi, Yen and Sterling in the short to medium term while Euro, Swiss and Dollar weaken across the board. Sudden shift in Yen demand signaled that markets are cautious ahead of Feds Powell’s testimony to the US congress on Tuesday.

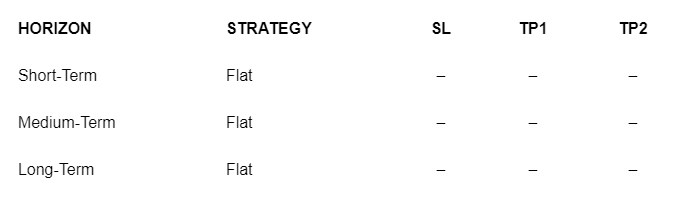

OUR PICK – No new pick

No new pick on rising VIX. Markets is throwing a tantrum on the possibility of an early rate hike but we are convinced that Fed’s Chief Powell will re-assure Feds stance to the US congress. Rates will remain low for a considerable amount of time until unemployment returned to pre-pandemic level. The dip in equities seemed temporary and new stimulus might see inflows back to US equities. Small value caps have been the favor for a while and will continue to be so as players rotate in our opinion.

Trades updates: AUY was stopped out, KR remains active, Sterling short-term finished breakeven, Euro long is on the way to long term TP2 and USD/CAD buy stop wasn’t filled but stopped out if you execute at market.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.