Stocks Rebounded on Feds Support

MFMTeam

Publish date: Wed, 24 Feb 2021, 08:26 AM

STATE OF THE MARKETS

Stocks rebounded on Feds support. US stocks rebounded in late afternoon trading after Feds chief’s Jerome Powell reiterated Feds dovish stance at the US Senate banking committee hearing Tuesday. Dow (+0.05%) and S&P500 (+0.13%) closed higher except the tech heavy Nasdaq (-0.50%) that face heavy liquidation on over valuation concerns. Demand for bonds returned with yields for US 10Y eased lower around 1.343% after hitting 1.389% high on rising rate concerns.

Crude edged lower on heavy profit taking after a long four months rally without major pullback. The black gold settled around $62/bl in late London trading before dipping lower as New York session ended. Gold struggled to sustain demand but remains closed above the key $1,800/oz as rising inflation remains a concern.

In the FX space, demand for safe-haven Swiss and Yen eased across the board while supporting the Greenback, while The Comdolls and Sterling continue to reign in demand as Euro remained subdued across the board. RBNZ decision to stay put today has seen its currency jumped to a two year high around ¥77.82 in Tokyo.

OUR PICK – TEVA Pharma (TEVA, NYSE)

When fundamentals and technical converge. Teva Pharma is world’s largest generic drug manufacturer that lost favor from Wall Street as the company faces over 2,000 lawsuits from states, municipalities and counties over its role in exacerbating the opioid crisis in the US. The stock lost nearly 80% it’s value, after a drop from over $72 in July 2015 to around $10 in March last year. Good news, it wasn’t affected as much by the pandemic as the stock is already at 1997’s valuation. At 3.8 times forward PE, 0.7 times revenue, and 0.05 times adjusted free cash flow; S&P Global Market Intelligence sees this stock has 34% upside before it reached it’s fair value.

Technically the stock is currently at channel support and and we saw heavy settlement at $10.61 today (23/2) with rising bid. Nevertheless, we could not rule out further dip to $10.00 to $9.50 area where more buying interest were seen. Current quarter saw a net 9.2 million institutional shares purchased while major shareholders added 3.9 million more shares.

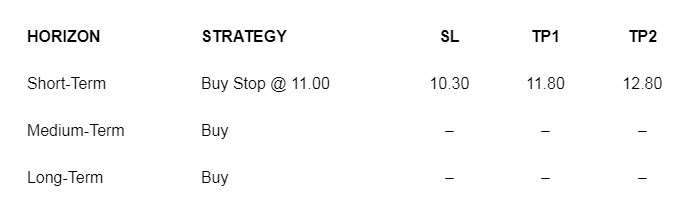

A buy stop above $11.00 with $10.30 stop would be safer in our opinion in case the stock dropped further, where better risk reward awaits. Aggressive trader may execute at market but be ready to ride the possible dip.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.