Equities Higher As Optimism Returned

MFMTeam

Publish date: Thu, 25 Feb 2021, 08:30 AM

STATE OF THE MARKETS

Equities higher as optimism returned. Global equities from S&P500 (+1.14%), Dow (+1.35%), Nasdaq (+0.99%), FTSE100 (+0.50%), all climbed higher Wednesday; including Nikkei (+1.54%) as Japan re-opened for trading after local holiday. Market optimism has returned after Feds chief Jerome Powell reassured that Feds will maintain ultralow rates and continue the bank’s monetary policies. US bond futures saw a flow of more than $260 billion of block orders as the 10Y yields remains in the 1.405% region.

Crude futures continue its upward trajectory as more than $368 million worth of block orders rushed when the black gold hit $63.50/bl while speculators were seen with ready offers at the $64-64.20/bl levels. Gold remains suppressed below the $1,800-1820 levels as yields seekers preferred bonds over the anti-inflationary asset; though bidders were strong in the $1,780 region.

In the FX space, not much changes were observed since Tuesday as demand for safe-haven Swiss and Yen eased across the board while supporting the Greenback and Euro. The Comdolls continue its reign in demand while Sterling retreated on profit taking in the short-term while remain at the helm of demand in the long term.

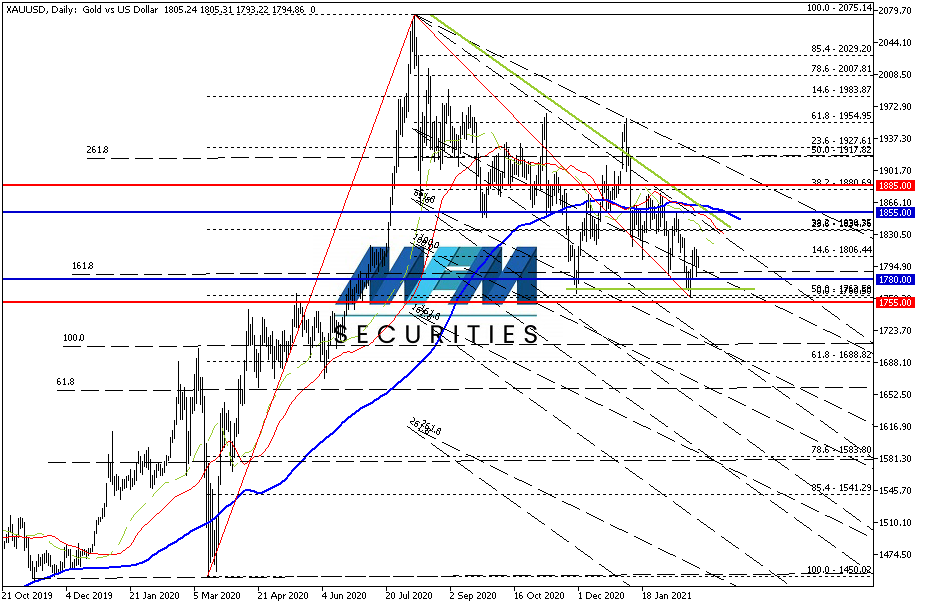

OUR PICK – XAU/USD

In a tug of war. The precious metal gold right now is in a tug of war between aggressive sellers and aggressive buyers. This was evident in the order flows of the futures markets and the balance of power, as of this writing, was skewed towards the sellers. Buyers were strong in the $1,760-80 area but not as strong as the sellers in the $1800-20 area; and if this trend continue, we might see another dip lower.

Looking at the big picture however, it’s obvious that the precious metal is in a pullback of a long term uptrend as evident in the pennant chart pattern. Indeed $1,780 and $1,855 are the weekly and monthly pivots respectively. So the tug of war is of no surprise. We can play the range and since at this point, price is closer to the weekly pivot, we’ll favor a buy and a sell is possible as price hit the upper band. Price had tested the 50% retracement twice now and there is still risk to the downside (61.8% – circa $1,700/$1,688) as much as to the upside given the tug of war between the $1.9T stimulus and rising yields. Trade management is key in this strategy.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.