Equities Surged As Yields Eased

MFMTeam

Publish date: Tue, 02 Mar 2021, 08:39 AM

STATE OF THE MARKETS

Equities surged as yields eased. Global equities surged higher on Monday as yields eased after demand for safe haven bonds returned. S&P500 (+2.38%), Dow (+1.95%), Nasdaq (+3.01%), and FTSE100 (+1.62%) was up, while Nikkei (-0.97%) took a breather in Asian trading. More than $72 billion flowed into the US treasuries as the benchmark US 10Y yields settled around 1.43% after concerns over rising interest rate subdued.

Crude futures (-1.43%) slid further as tensions between the US and Saudi grows, ahead of the OPEC+ meeting this week that could see Russia pressing for loosening of supply cut. The black gold is trading around $60/bl as of this writing and was under selling pressure. The yellow metal gold, continued to be under pressure, trading around $1,720, after rising yields boosted demand for the greenback. The inflationary effect of the new $1.9 trillion stimulus is yet to be seen.

In the FX space, Dollar took the helm of demand in the medium term as it notched up in the long term. Demand for safe-haven Swiss and Yen were stabilized across the board, indicating a more risk-on environment. Euro and Sterling was in a tug of war as investors digested further the implication of Brexit on European financial markets. The Comdolls remained in the demand camp, even after the sell-off last week, as RBA left its monetary policy unchanged today. As of this writing, Aussie retained steady bid around ¥82.80 in Tokyo.

OUR PICK – EUR/JPY

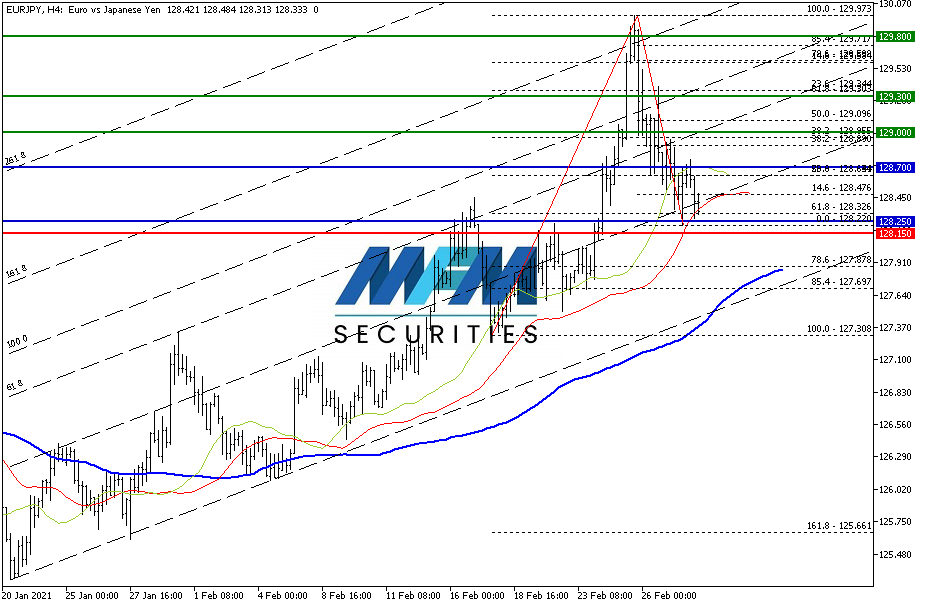

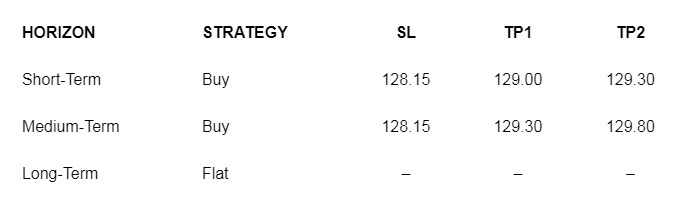

Riding on block orders. FX sentiments showed that long term EUR/JPY is deteriorating but still a buy and just a block apart in the medium term. Recent short-term sell-off was mostly profit taking and a block orders of $23 million was recorded Monday in the futures market. We intend to ride that orders with 128.15 stop.

Technically, the pair is in uptrend while resting on monthly pivot around ¥128.25 and facing weekly pivot above around ¥128.70 as of this writing. In our view, there is still downside risk of it testing the lower bound channel around ¥128.00/127.80 where we would re-enter in case of a stop-out. New stop then would be ¥127.50

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.