Equities Sunk as Yields Jumped, Again

MFMTeam

Publish date: Thu, 04 Mar 2021, 08:17 AM

STATE OF THE MARKETS

Equities sunk as yields jumped, again. Global equities sunk on Wednesday as US bond yields jumped, with the US10Y benchmark hit 1.5% while investors wait for Feds Powell comment on Thursday. In another news, ECB was unwilling to intervene on the same scenario when French and German bund spiked albeit still in negative territory. Rising interest rates spurred risk aversion among investors as fear of tapering might come sooner than later.

Crude futures rebounded and settled higher, around $61.28/bl, on news of significant inventories reduction while sources said that OPEC+ might keep its production cap intact for now. Gold struggled to maintain the buying momentum and closed lower, around $1,710.95/oz, as yields seeking investors preferred the Greenback over the anti-inflationary hedge.

In the FX space, Dollar returned to helm of demand in the short-term as fears sent high beta Aussie and Kiwi to the back seat, while buying more Swiss and Yen. Euro and Sterling were in a tug of war as tension on Euro clearing continued to rise between London and Frankfurt. Risks sentiments seemed off but hope on global economic recovery was high as crude backed Loonie remained in demand.

OUR PICK – Altria Group (MO, NYSE)

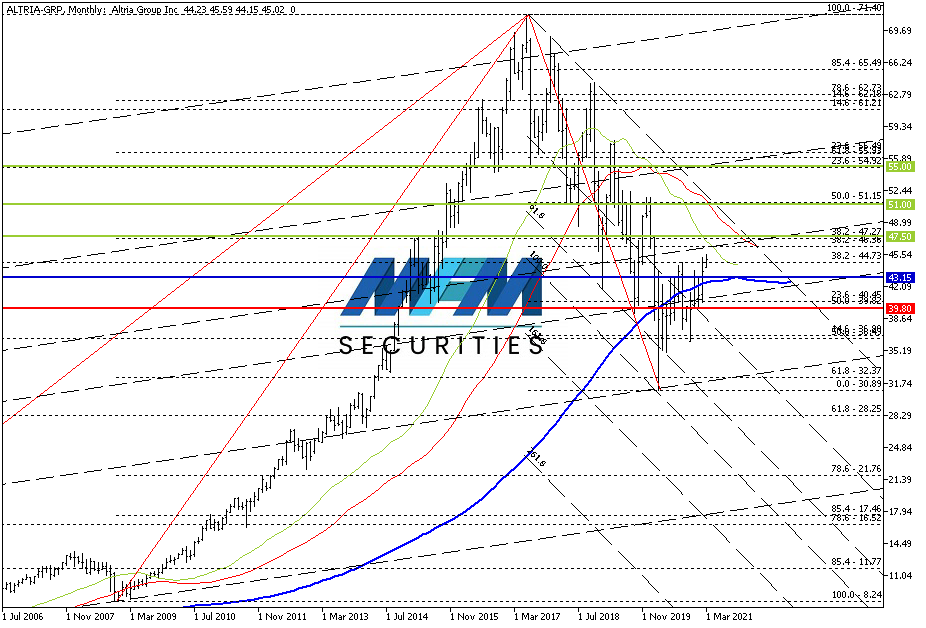

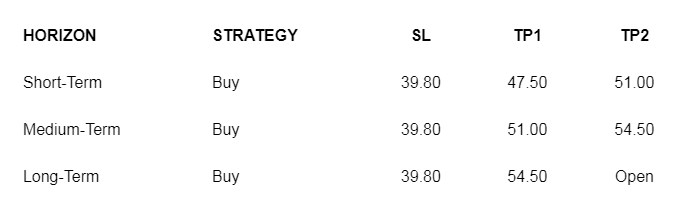

An income stock to hold. Treasury yields might increase but it’s hard to beat inflation at 1.5% though it offers a peace of mind. At extra risk premium, Altria group at current price, offers 7.6% annualized yields that definitely beat inflation, at least for now. The company has been among the most consistent dividend payer with increasing dividends year after year since 2010. Though it missed Q4,2020’s earning estimate by 3 cents, the stock remained on bid after $0.86/share dividend was declared on Feb 26th. With 24/3 ex-dividend date, we see income investors bidding on this stock to continue.

A long term income investors won’t mind keeping this stock forever though S&P GMI’s estimated fair value of this stock is around $54.50. Major shareholders were seen adding around 1.8 million shares as of last quarter though overall, there were more net institutional outflows (46.3m) than inflows (42.8m).

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.