Rising Yields Buoyed Dollar

MFMTeam

Publish date: Tue, 09 Mar 2021, 08:51 AM

STATE OF THE MARKETS

Rising yields buoyed Dollar. More than $150 billion flowed in the US bonds futures as the 10Y yield rose to 1.61% in the early session Monday, after $1.9 trillion stimulus was passed by US Senate earlier. Spike in the yields amid falling demand in the US treasuries, prompted investors to liquidate equities holdings with more than $3.5 billion securities was sold by insiders last week. US equities closed mixed with Dow (+0.97%) and Russel (+0.49%) were up while S&P500 (-0.54%) and Nasdaq (-2.41%) edged lower.

In early trading, crude futures spiked as high as $70/bl after news about attack on Saudi oil facilities hit the wires; but retreated lower after no casualties or loss was reported. Rising yields continued to press the yellow metal gold lower, below $1,680/oz for the first time in 9 months; which continue to buoy the Greenback amid its short-covering.

Demand for safe-haven Swiss and Yen remain modest and suggested improved risk appetite, as Aussie and Kiwi was running on the back foot in the short-term amid profit taking. Euro continued to be outbid by Sterling, though short term accounts showed that the gap is reduced, while Loonie remained bid amid rising crude price.

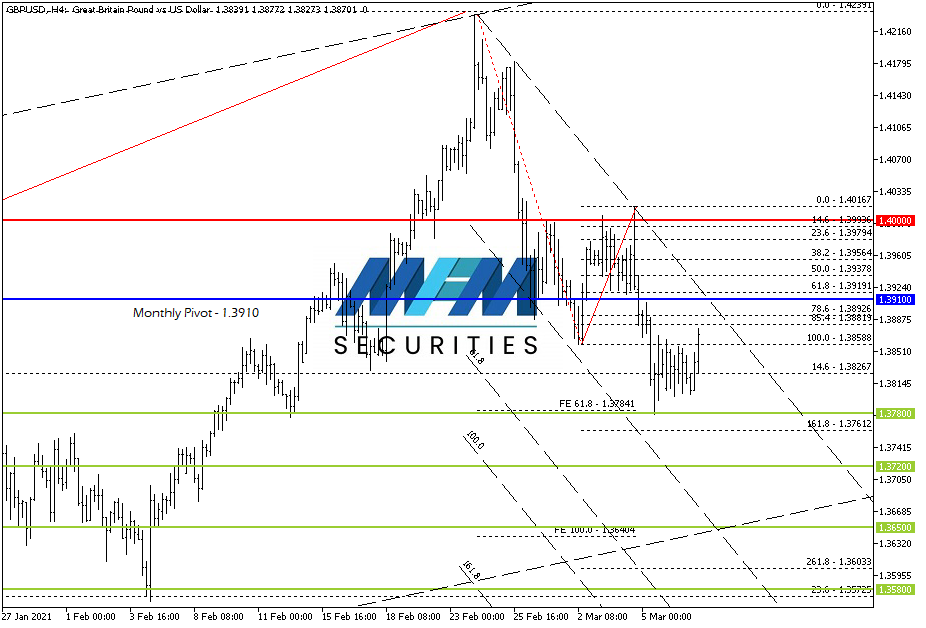

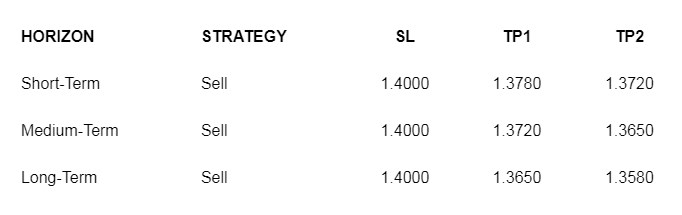

OUR PICK – GBP/USD

Credit spreads point to lower Sterling. Other than our FX sentiments showed a mildly bearish GBP/USD in the short to medium term, current credit spreads favor USD long against EUR, CHF, GBP and JPY shorts. Though Brexit is pretty much settled and buoyed Sterling higher for the past 10 months, the issue of relocating Euro clearing from London to Frankfurt is going to haunt Sterling in the long term, in our opinion. Rising US yields is also going to ease traders in covering their huge Dollar short that had been built up since Spring last year. Sell on rally is our preferred strategy.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.