Bonds Demand Returned Amid Risk-On

MFMTeam

Publish date: Thu, 11 Mar 2021, 08:28 AM

STATE OF THE MARKETS

Bonds demand returned amid risk-on. More than $700 billion flowed into US bond futures in various maturities as US equities continue to surge higher on Wednesday. Dow (+1.46) made an all time high at 32,389.50 while S&P500 (+0.60%) gapped higher and Nasdaq (-0.04%) remained under pressure. The benchmark US 10Y yields continued lower, to close below 1.51% as safe-haven flows continued.

Crude recovered earlier losses, closed above $64.40/bl, as demand outlook improved more than the surge in inventories due to last month Texas winter storm. More than 13 million barrels were added according to EIA. Gold continued higher, closed above $1,726.00/oz, as markets repriced Dollar with the new $1.9T stimulus that will be signed this Friday.

Dollar continued to be bid lower, with DXY closed below $91.83, but remained supported by Swiss in the short-term as Sterling, Euro and the Comdolls advanced in demand. Dollar demand in the medium term edged lower while remained unchanged in the long term accounts. Risk sentiments remained relatively stable, with largest gain seen in Euro as ECB is expected to stand pat on Thursday.

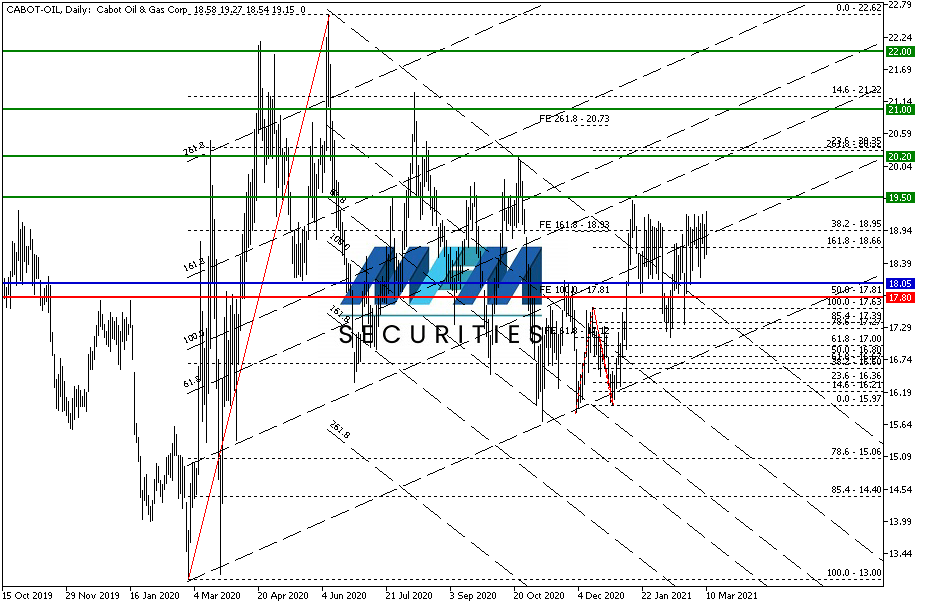

OUR PICK – Cabot Oil & Gas (COG, NYSE)

Heavy accumulation is going on. With economic outlook and oil demand improved, oil and gas companies are gaining in demand. Some are more than the others. While RRC, SWN and EOG has advanced more than 80% in price for the year; COG is close to only 10% and heavy accumulation is going on. The company continue to beat earning estimates for the past three quarters and 10% undervalued by S&P GMI standards. With dividend yields stands at 2.16% and 80% payout we like this stock.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.