Stocks Surged Higher on Stimulus

MFMTeam

Publish date: Tue, 16 Mar 2021, 09:39 AM

STATE OF THE MARKETS

Stocks surged higher on stimulus. US stocks surged higher on Monday after some households reported receipt of second stimulus checks. Dow (+0.53%) and S&P (+0.65%) made a new all time high, while Nasdaq (+1.05%) recovered some earlier losses. S&P500 was led by utilities (+0.97%) and real estates (+0.89%) as materials (-0.28%) and energy (-0.18%) took a pullback. The US 10Y benchmark edged lower than Friday, but still above 160 basis points.

Crude was seen to be under selling pressure, closed below $65.40/bl, as more investors took profits off the table, preparing for the Feds minutes this Wednesday. Gold continues to be on bid, closed above $1,730.75, as markets priced the new stimulus effects on inflation.

In the FX space, Dollar index (DXY) closed higher, above 91.80 mark, but seen under selling interest from 92.40 below. Medium term points to Dollar weakness, though long term accounts seemed to favor the Greenback. Investors continue to be cautious as Swiss demand gained traction in the short to medium term accounts, while Euro came under pressure. Germany, Italy and France suspended AstraZeneca shots after serious side effects were reported in several countries. At this point, market seemed mixed with optimism and caution at balance.

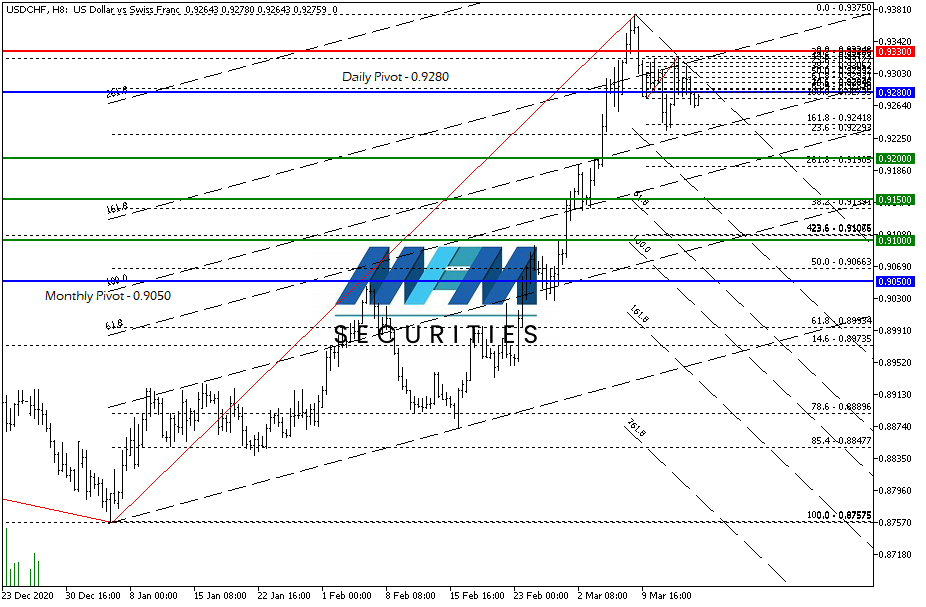

OUR PICK – USD/CHF

Medium term weakness on safe-haven flows. Our FX risk sentiments suggested that short and medium term accounts are positioning for Dollar weakness. We see Germany, Italy and France decision to suspend AstraZeneca shots after serious side effects were reported in several European countries; might prompt a medium term safe-haven rally. Except for Aussie, orders point to more Yen flows than any other G10 currencies; which indicates markets are getting more cautious. We prefer USD/CHF than USD/JPY on clear technical setup.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.