Stocks Mixed Waiting on Feds

MFMTeam

Publish date: Wed, 17 Mar 2021, 09:23 AM

STATE OF THE MARKETS

Stocks mixed waiting on Feds. US stocks closed mixed on Tuesday, with Dow (-0.39%) and S&P500 (-0.16%) took a dip after an all time high while Nasdaq (+0.09%) climbed further to regain earlier losses. Markets seemed jittered waiting for Feds chair Powell’s comment on rising inflation and recent spike in Treasury yields. Concerns were also raised by the weaker than expected retail sales and industrial production. The benchmark US 10Y yielded higher above 1.62% as the paper lost bid.

Crude was sold-off as market opened, before making a rebound to close around $64.80, lower than Monday $65.40/bl after concerns on third lockdowns in Europe might hamper demand. Gold continued to be in a tug of war as buyers and sellers gauge rising inflation and yields. The non-interest bearing metal settled relatively unchanged around $1,730.95/oz as New York closed.

The jitters and reduced optimism can be seen in the FX space as Swiss took the helm of demand with Yen advanced further in the short term as Dollar edged lower. Other than Loonie, the high beta Aussie and Kiwi were seen running on their back foot as short-term traders seek cover in safe-havens.

OUR PICK – NIO (NIO, NYSE)

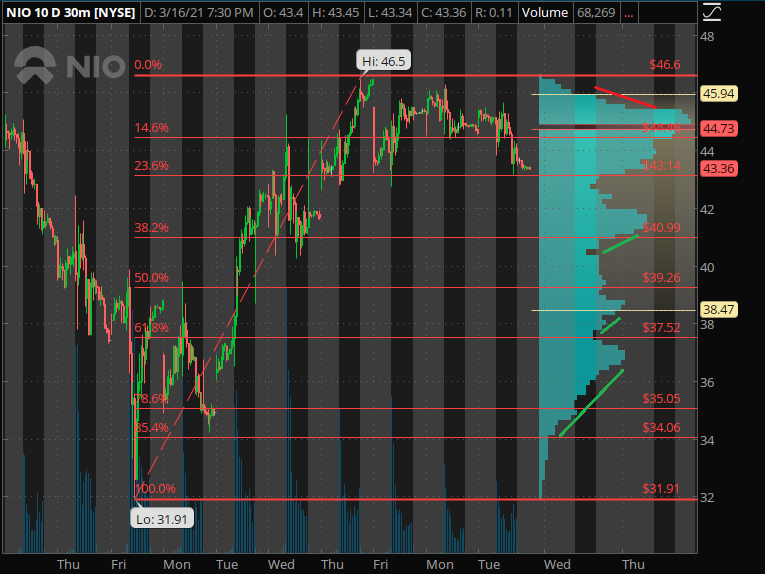

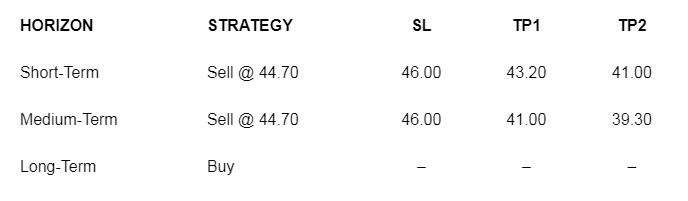

The Tesla of China. As of today, fundamentally this company is yet to produce earnings. The revenue growth had been strong but cost of goods sold and operational expenses have deemed continued losses in the last quarter. The worst than expected losses had trigged light sell-off, but we believe that the monthly low, circa $31.91, around 50% retracement of all time high to all time low is already in place. This was evident in a motive wave developed last week. We expect a pullback this week to around 50% – 61.8% ($39.26 – $37.52) for a long opportunity. Short and medium term traders may prefer short to the downside but cut loss if daily closed above $45.00

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.