Stocks Rebound And Safe Haven Flows Continue

MFMTeam

Publish date: Tue, 23 Mar 2021, 09:22 AM

STATE OF THE MARKETS

Stocks rebound and safe haven flows continue. While US stocks recovered some of the earlier losses, led by consumer staples, real estate and health care; safe-haven flows continue to dominate order flows as Swiss took the center stage in the FX markets as market opened on Monday. Quite likely, a selling climax might have occurred in the US 10Y bond with demand stabilized, yielding slightly below 1.7% as New York closed.

Crude struggled to closed higher, remained capped below $61.55/bl as investors weigh the demand concerns on renewed lockdowns in Europe; while gold took a dip, closed below $1,738.70/oz. Last week had seen heavy hedging as the yellow metal advanced in tandem with the Greenback.

Long term accounts seen heavy Dollar bidding while short and medium term dumped the world reserve currency, in favor of the Swiss, Yen, Euro and Sterling. Medium term outlook is bearish as high beta commodity currencies were sent to the back seat while safe-haven flows took the helm of demand.

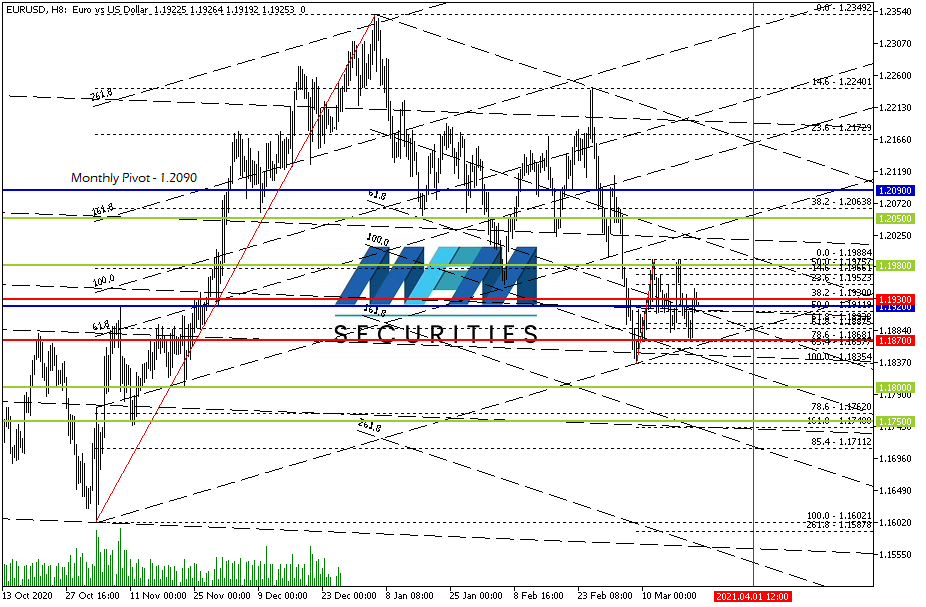

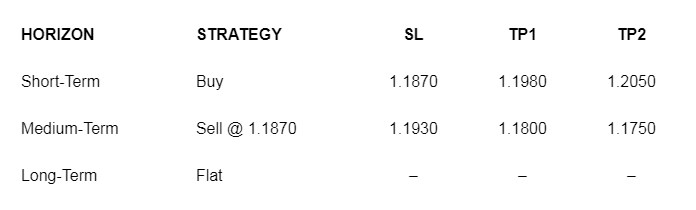

OUR PICK – EUR/USD

Dollar weakness is not over yet. Selling climax in the US 10Y bond, with renewed buying interest, suggested that yields will cool off for a while, which will cap Dollar strength in the short-term at least, in our view. Feds being firmed on their monetary policy, will spur heavy hedging in the medium term as we have observed in rising gold, rising Dollar phenomenon recently. We pick EUR/USD on flows merit, for the short term, as this pair has negative swaps. Though probably low, downside risk remains, if 1.1870 does not hold; so we’ll short on stop.

Please bear in mind this pair has over 80% daily and 60% weekly negative correlation with USD/JPY.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.