Markets Turned Risk-Off

MFMTeam

Publish date: Wed, 24 Mar 2021, 09:22 AM

STATE OF THE MARKETS

Markets turned risk off. Risk-off sentiments swept the markets on Tuesday as US Feds Chair Jerome Powell and Treasury Secretary Janet Yellen answer to a two day congress testimony. Major US index, Dow (-0.94%), S&P (-0.76%) and Nasdaq (-1.12%) took a dip, while flight to bonds safety was observed forcing 10Y yields to drop lower, below 1.62% as flows to cash drove the Dollar index to close above 92.40 for the first time in 4 months.

Crude plunged deeper into the red, below $57.50/bl, after report of rising oil inventories exacerbate the already distress commodity markets about the vaccine rollout setbacks in Europe and Southern Asia. Even gold was sent lower, below $1,726.95/oz after investors dumped Aussie and Kiwi across the board, while demand more Swiss in the long term.

The panic was obvious as Yen took the reign of short and medium term accounts, while advancing further in the long term demand territory. More Euro than Sterling flows were also seen in the short and medium term, confirming the risk-off sentiments. Long term outlook is mildly bearish amid the US congressional testimony on the world’s largest economy.

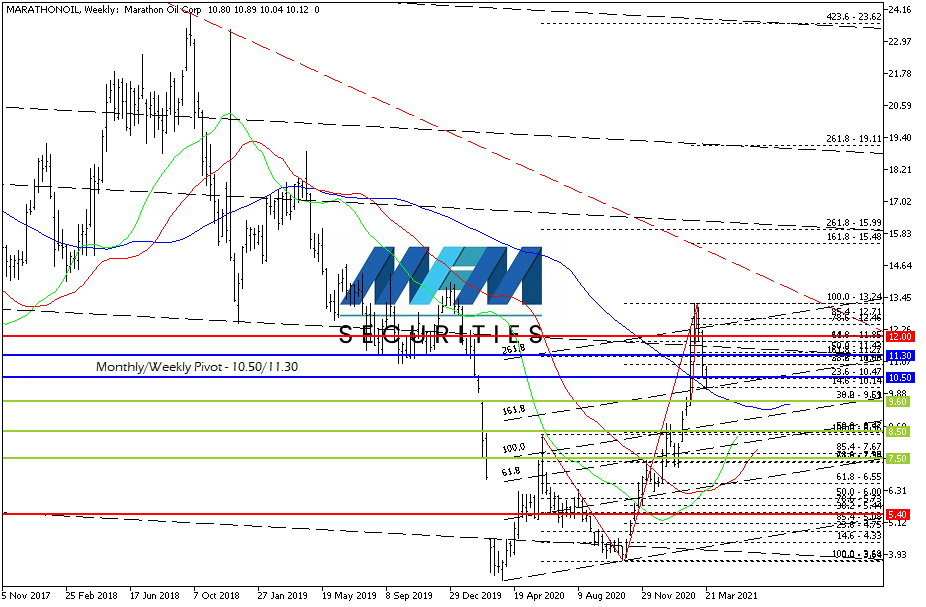

OUR PICK – A revisit to Marathon Oil (MRO, NYSE)

Trading the pullback. Early December last year, we pointed to the bottom in oil stocks, and our pick, MRO, has reached it’s long term TP1 and was just shy of few dimes to TP2 earlier this month. We believe current predicament that is hitting Europe’s and Southern Asia’s vaccine roll-out will put a pressure on crude price and oil stocks. The top is most likely already in place and we are now on the short side for the short and medium term. Long term is neutral, for now.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.