Risk Off Continues

MFMTeam

Publish date: Thu, 25 Mar 2021, 09:37 AM

STATE OF THE MARKETS

Risk off continues. Risk-off sentiments continue to plague the markets, after US congressional testimony on the world’s largest economy finished on Wednesday. Investors seemed to brush off the optimism expressed by Chair Powell and Secretary Yellen; as Dow (-0.01%), Nasdaq (-2.01%) and S&P500 (-0.55%) slid lower, while gold (+0.05%) and Dollar index (+0.28%) edged higher. Higher bond prices on increased demand, forced the 10Y benchmark to slide 0.01% lower to 1.61%.

Crude rebounded higher after Suez canal incident hit the markets, sending the black gold to closed above $60.80/bl, overshadowed demand concerns on Europe and South Asia renewed lockdowns. Gold regained bid, above $1,734/oz after Feds disregard inflation concerns, on a new $3 trillion fiscal spending plan by the Biden administration.

In the FX space, slight repositioning was observed as end of March and first quarter is around the corner, with more Dollar short-covering across the board at the expense of Aussie and Kiwi; while Loonie remained strong in demand. Euro continue to overbid Sterling across the board, suggesting the base in EUR/GBP is in place. Short-term outlook seemed bullish as Kiwi moving higher in demand as Yen retreated, while Swiss remain stable in the medium and long term accounts.

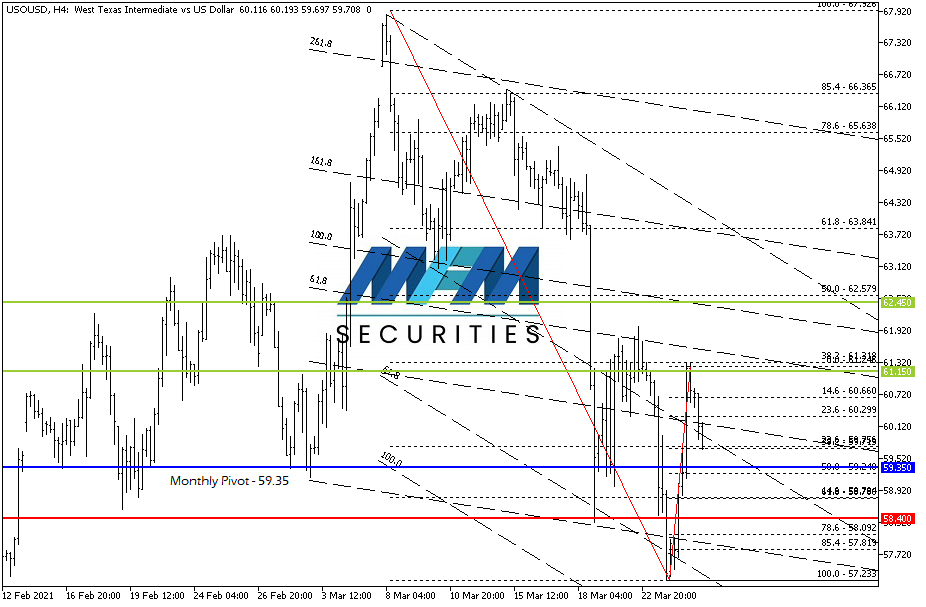

OUR PICK – Crude Oil

Bullish short-term. The Suez canal incident that block shipments of worldwide cargo is going into the third day now. Suez Canal Authority estimated that the best chance to re-float and free the stuck ship may not come until Sunday or Monday when the tide will reach a peak. Even then, there is no guarantee that the massive 200,000 metric ton Ever Given ship will be able to pass as it’s now in wedged position. If cargo has to be unloaded to reduce the weight, this could take weeks and delayed shipment of oil supplies; which is positive for crude oil. However, medium to long term risk pointed to more downside due to vaccine rollout setbacks in Europe and South Asia that would hamper demand.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.