Stocks Mixed As Investors Cashing Out

MFMTeam

Publish date: Tue, 30 Mar 2021, 09:20 AM

STATE OF THE MARKETS

Stocks mixed as investors cashing out. US stocks closed mixed on Monday, with Dow (+0.30%) piercing new high while Nasdaq (-0.60%), and S&P500 (-0.09%) edged lower, as long term leveraged funds were seen unloading more shares on profit taking, after Archegos forced liquidation on Friday. Investors were seen to run for more cash than bonds or gold, forcing the yellow metal to close lower while yields edged higher. Yield on 30Y bonds was seen to hit 2.41%, its highest since November 2019.

Crude climbed higher, above $61.50/bl, after OPEC+ was reported to rollover its production quota until the next meeting. The Suez Canal incident has been resolved, but demand concerns in Europe and South Asia still plague the markets. On the other hand, gold was under selling pressure as flight to cash drove the Greenback higher. The yellow metal closed below $1,720/oz mark and still trending lower as of this writing.

King Dollar continue to reign in the short and medium term, albeit a retreat to Loonie in the long term, as month and quarter end is around the corner. As the short-week will see US employment figure this Friday, FX sentiments suggest that markets are in a wait and see attitude and remain cautious.

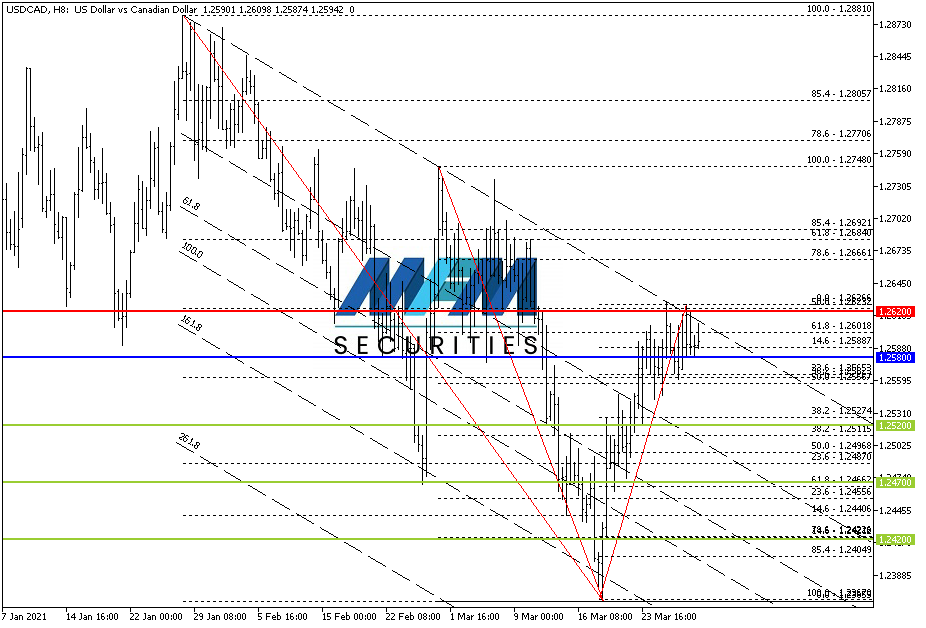

OUR PICK – USD/CAD

Yields still favor CAD. Though investors are making a big deal of the USD yields, truth is, USD yields spreads only beat CAD on a 7 year note (1.32% vs 0.95%). 1, 2, 3, and 5 years note still favors CAD by some good margins, even on the shorter 1, 3, and 6 months note. (Refer to the matrix below)

So obviously the rise of USD/CAD exchange rate for the past two weeks has been mostly on short covering and flight to safety, we believe. Subsequently when the markets calmed, USD will lose bid to CAD, and the exchange rate normalized, albeit the monthly low, might has formed the base for USD, given current sentiments in the equities market in our view. Month and quarter end might also see some USD sales for rebalancing, so we favor sell stop @ 1.2570 for the short and medium term, while buy for the long term.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.