As Markets Wait And See…

MFMTeam

Publish date: Wed, 07 Apr 2021, 09:20 AM

STATE OF THE MARKETS

As markets wait and see. Despite stronger jobs openings and higher IMF’s global GDP forecast, major US equities indexes, Dow (-0.29%), S&P500 (-0.10%) and Nasdaq (-0.05%), closed lower for Tuesday. Ahead of Q1 earnings reports, investors were seen on defense in bidding utilities, real estates and consumer staples; while on the sideline for healthcare, industrials and technology sectors. Meanwhile, moderate flows to bonds was also observed as the 10Y yields edged lower from 1.71% to 1.66%.

Crude staged a short lived rally to as high as $60.80/bl, before demand concerns pressed the black gold lower and settled below $59.20/bl. Gold on the other hand, advanced further above $1,743.50/oz after Dollar fell to the lowest level in two weeks on moderate volume.

The Dollar index (DXY) spot closed lower than the futures (DX), circa 92.30/35 mark, as medium term investors ran towards the safety of Swiss and Yen, while bidding for the high beta Kiwi. Euro finally managed to overbid Sterling and staged a rally in EUR/GBP in a quiet week for the Queen’s currency. The rest of the week seemed to be the battle between Dollar and Loonie as the duo wrestle in PMIs and employments figures.

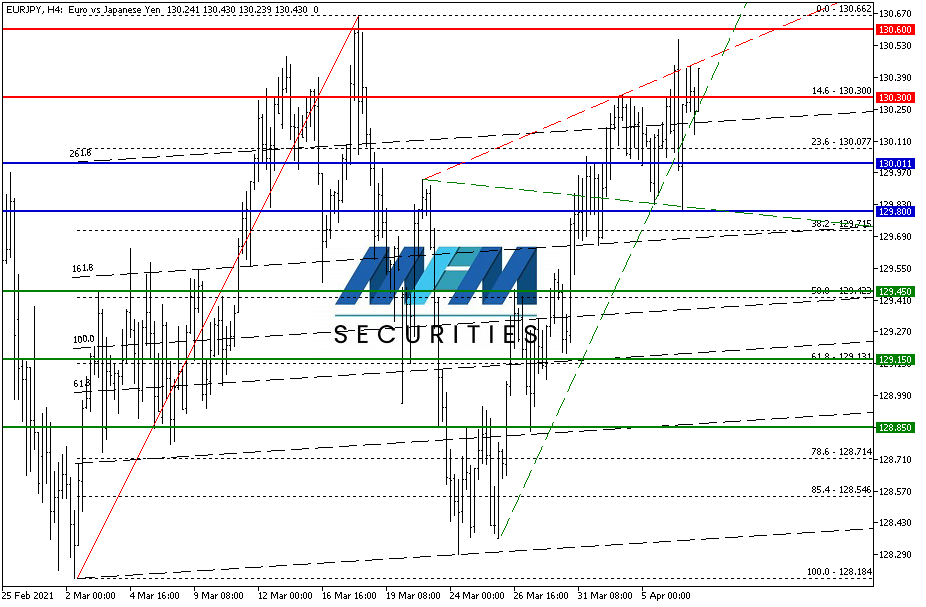

OUR PICK – EUR/JPY

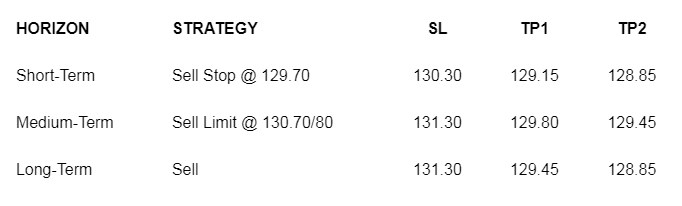

Riding the block orders. A block orders worth $11.2 million of EUR/JPY futures at ¥130.60 took place in the London session on Tuesday, though not huge, signaled an approaching long term supply area for the pair. On the monthly chart it can be observed that the pair is facing a long term resistance in its advance. Nevertheless, chart formations suggest that an upside risk is still present, for the pair to test ¥131 level. Sell limit at ¥130.70 or sell stop at ¥129.70 is our preferred strategy for the short to medium term. An open target is also viable to take any long term downside risk in our view. We would cancel the sell stop once the sell limit is filled.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.