Bulls Took A Breather Amid Profit Taking

MFMTeam

Publish date: Tue, 20 Apr 2021, 09:35 AM

STATE OF THE MARKETS

Bulls took a breather amid profit taking. US stocks took a breather Monday after making all time high last week, as long term investors were seen cashing some chips across the boards. Dow (-0.36%), Nasdaq (-0.98%), S&P (-0.53%) and Russell (-1.36%) all edged lower as bonds and Dollar were sold off. The benchmark US 10Y yield climbed back to 1.61% amid falling price as demand subsided.

Crude continued its upward trajectory to $64/bl on weaker Dollar, despite heavy selling pressure in the $63.20/50 region as speculators bet on demand concerns due to rising and re-emergence of a new Covid wave. Gold closed the day lower, below $1,770/oz as short tern traders took profit on the last two week rally after inflation fears sent the precious metal higher.

In the FX space, Dollar sell-off continued for the third consecutive week, with the Dollar index (DXY) breaking 91 mark as of this writing, mostly to the benefits of Sterling, Kiwi and Aussie. Investors remain cautious as Swiss and Yen are still in demand across the board. Sterling managed to overbid Euro in the short and medium term, though long term remains in favor of Euro.

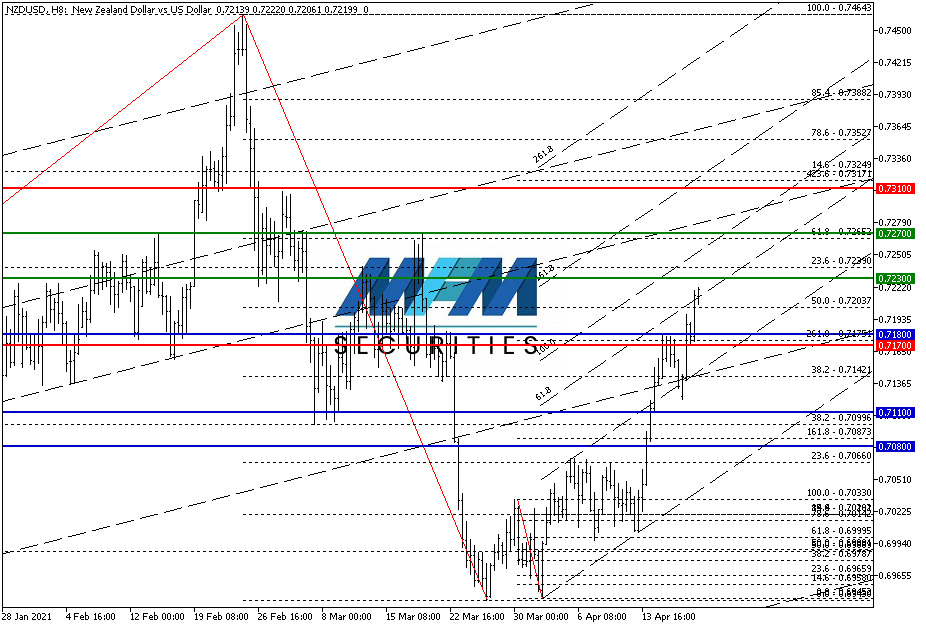

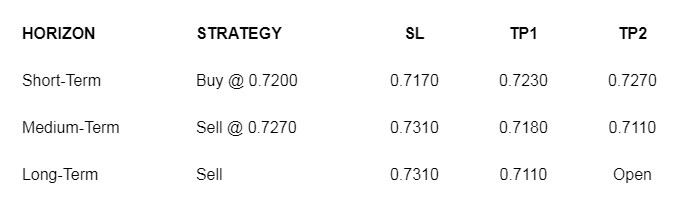

OUR PICK – NZD/USD

Better fundamentals but limited upside on technical. Recent release of a better than expected NZ business PMI, plus a weaker Dollar has fueled Kiwi rally last week. Since the pair closed above 50% fibonacci retracement of Feb high to March/April low yesterday, circa 0.7204, we see further upside to test 61.8% is still on the card as affirmed by our FX sentiments index. Nevertheless, 0.7220/50 is also the breakout from February’s low, i.e, support turned resistance. We might see medium to long term traders back in the shorts to push the pair down further.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.