Rising Yields Ahead of FOMC

MFMTeam

Publish date: Wed, 28 Apr 2021, 09:57 AM

STATE OF THE MARKETS

Rising yields ahead of FOMC. US stocks was trading flat on Tuesday, ahead of Federal Open Market Committee’s decision on US rates, while yields for the 10Y bonds rose back to 1.63% as of this writing. More than $270 billion flows into the US treasuries futures as Dow (+0.01%), Nasdaq (-0.34%) and S&P500 (-0.02%) saw negative breadth after three weeks’ net outflows of more than $9 billion worth of equities.

Crude continues to be overbid above $63/bl as news reported that OPEC+ still see higher demand despite covid crisis in India. The black gold settled around $62.95/bl as New York closed. Rising yields forced gold to retreat its advance, as the non-interest bearing instrument lost its appeal, below the $1,780/oz mark, benefitting the Dollar.

In the FX space, short term accounts seemed cautious as flight to Swiss ousted Loonie from the reign of demand, ahead of FOMC on Wednesday. King Dollar retreated in the medium term, as markets expect no change in Feds stance. Yen continue to be on offers against other majors as it retreated to the back burner. Aussie, Kiwi, Euro and Sterling was trading flat relative to other majors as markets awaits FOMC.

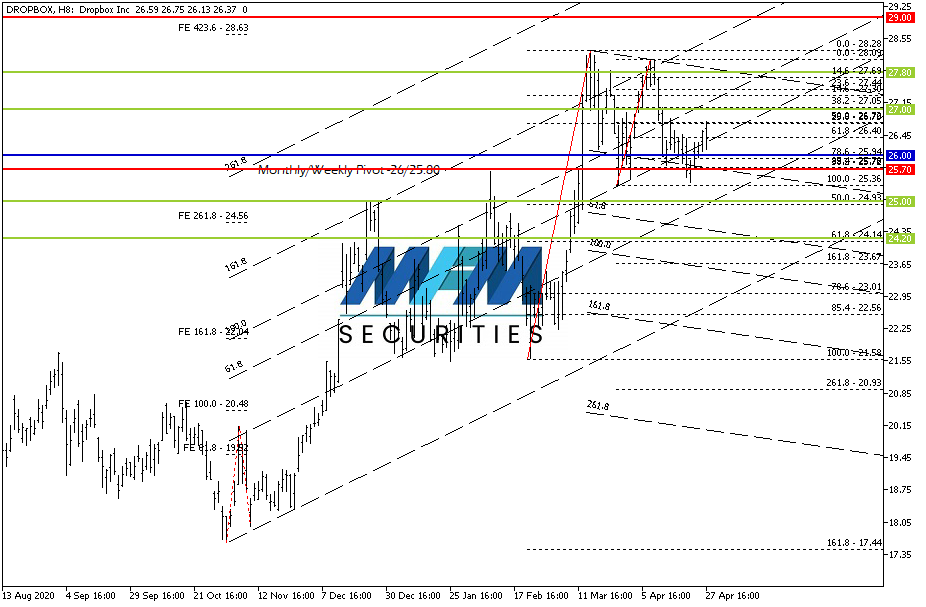

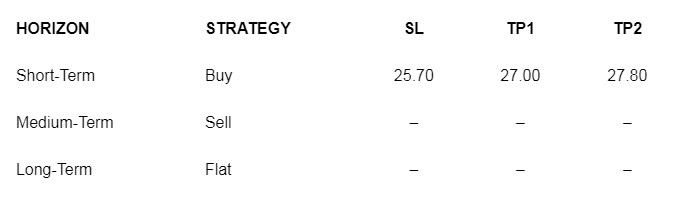

OUR PICK – Dropbox Inc (DBX, NASDAQ)

Rising revenues yet falling income. Once the hype stock of the day as cloud storage took center stage back in Spring 2018, DBX went on IPO debut and flew from around $30/share to $43.50/share in four months. A 45% upside before it tumbled to record low of $14.55/share last year, forcing many institutions to liquidate with net selling of more than 11 million shares by the last quarter. Earnings beat estimates for the past three quarters, yet income still falling to net losses due to heavy expenses. With earning results due on May 6th and dovish Feds, this stock may has limited upside in our view but insider pointed to selling trends; which is our preferred medium term strategy. At this point, Fibonacci signaled a full expansion at $28.63, where we might jump into shorts later.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.