Stocks Tumbled Amid Risk-Off Sentiments

MFMTeam

Publish date: Wed, 05 May 2021, 09:35 AM

STATE OF THE MARKETS

Stocks tumbled amid risk-off sentiments. Growth stocks tumbled across the board as risk sentiments turned sour after comments from Treasury Yellen that rate need a hike soon. Major US index – S&P500 (-0.67%), Nasdaq (-1.88%), including Russell200 (-1.28%) – was sold off, though Dow (+0.06%) edged higher as investors ran to blue chips defensive stocks. Bonds market saw heavy inflows forcing yields to dip, with the 10Y benchmark fell to as low as 1.56% before settled around 1.59% as New York closed.

As of this writing, crude continues its upward trajectory, closed above $66/bl for the first time in 24 months, as markets focused on US and Europe re-openings, instead of rising death in India and Brazil. Gold took a dip on profit taking, closed above $1,778.50/oz, as markets weigh Yellen remarks afterwards.

In the FX space, King Dollar seized the reign of demand in the short term, backed by Swiss, Yen and Loonie as risk off sentiments sent Aussie and Kiwi to the back burner. Sterling continues to overbid Euro, in the short to medium term, but coming Scottish election and BoE decision on Thursday might trigger offers on Sterling.

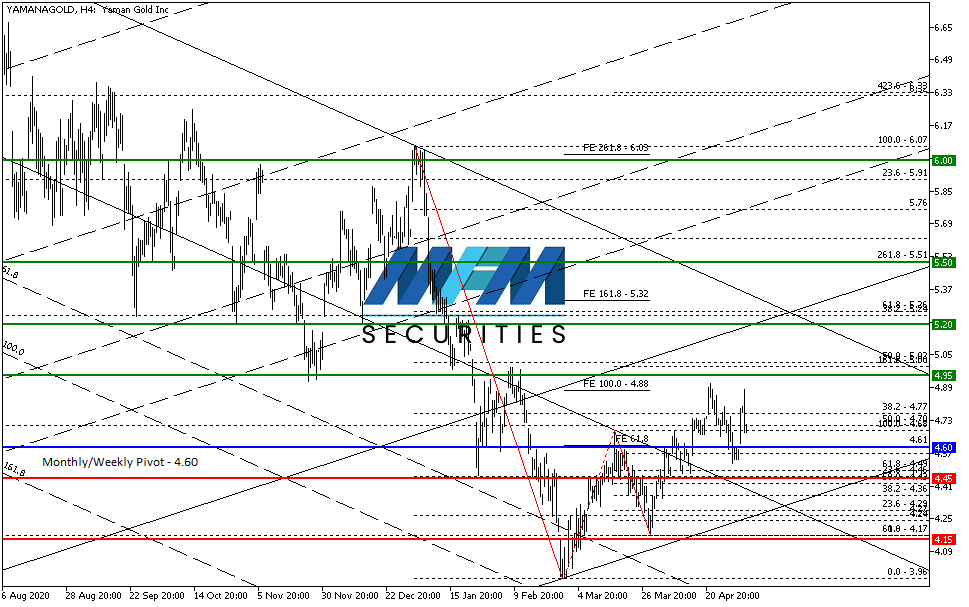

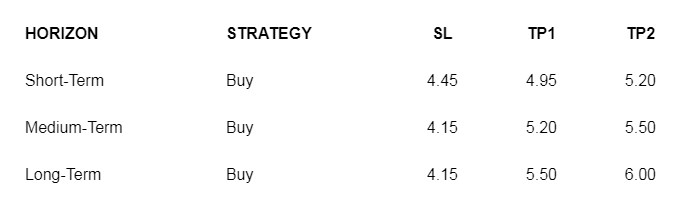

OUR PICK – Yamana Gold (AUY, NYSE)

Upcoming Dividends. Recent earnings met estimates and the company declared a three cents dividend for on record of June 30th and payable on July 14th, which we see might sustain price to the upside. Bullish sentiments in gold, might also help buoyed demand from investors seeking inflationary protection. As we do not see Yamana go bankrupt in the next 12 months, the 1.80% TTM (trailing twelve months) yields seemed attractive to us to hold the stock for long term without stop loss on our cash account (1:1 leverage).

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.