Risk-Off Continues

MFMTeam

Publish date: Tue, 18 May 2021, 09:27 AM

STATE OF THE MARKETS

Risk-off continues. Global equities closed lower on Monday after higher US inflation numbers and dismal employment figures sent a wave of sell-off last week. S&P (-0.25%), Dow (-0.16%) and FTSE (-0.15%) lost bid while Nikkei (+2.33%) tracked some gains even after reports of contracting GDP. Flight to safety was observed as more than $260 billion worth of block order flowed into US treasuries futures as the 10Y benchmark jumped back above 1.65% and gold broke the $1,850/oz barrier.

Crude futures firmed above $66.20/bl after improved demand outlook amid increasing travel numbers was reported over the weekend. Flight to safety and inflation concerns continue to project gold upwards as it broke the $1850/oz barrier and closed above $1,866/oz – the highest in 15 weeks.

In the FX space, King Dollar received firm bids from medium term accounts, while Loonie and Sterling remained in the helm of demand across all horizons. In the short and medium term accounts, Aussie and Kiwi were seen heavily offered on profit taking, while Euro and Yen gained traction in demand. Bearish outlook might be lurking as earnings season is about to come to an end.

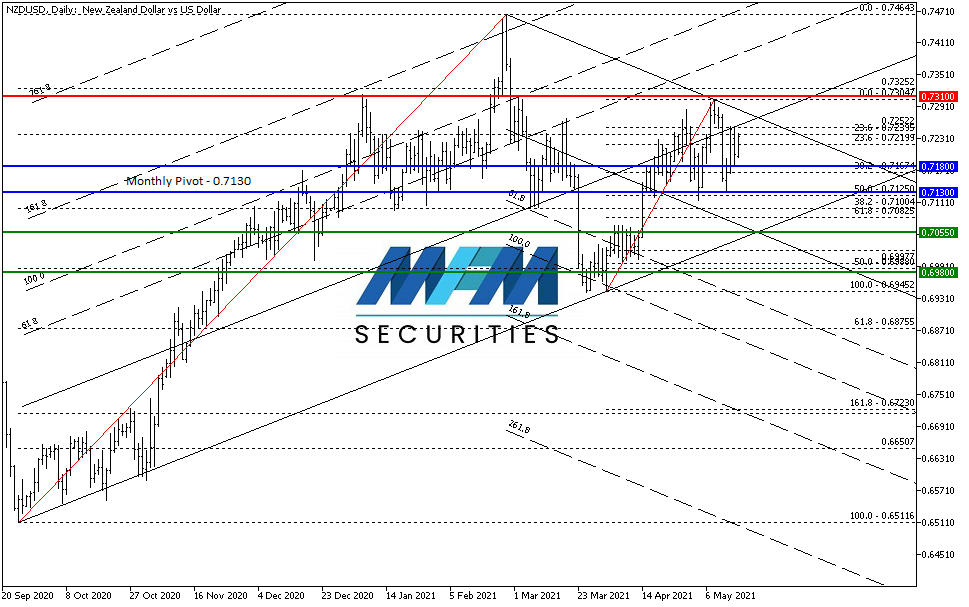

OUR PICK – NZD/USD

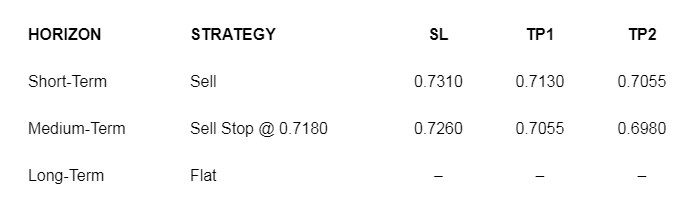

Re-entry into shorts. Our last short on Kiwi ended being breakeven but April’s failure to close above December’s close is indicating bears regaining strength as confirmed by our short and medium term FX sentiment index. We see rising US yields will continue to support the Dollar in the interim as continued risk off will send the Kiwi on offers. We prefer to sell on stop @ 0.7180 to confirm the selling pressure while at the market may see May’s high as stop.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.