Dollar Buoyed As Yields Firmed

MFMTeam

Publish date: Thu, 27 May 2021, 09:23 AM

STATE OF THE MARKETS

Dollar buoyed as yields firmed. US stocks edged higher on Wednesday, after Fed’s officials said the talks about tapering are just talks and do not affect the current stance of monetary policy. Dow (+0.03%), Nasdaq (+0.59%), and S&P (+0.19%), including Russell (+1.97%) advanced on the news, with Dollar index (DXY) closed above 90 mark as the 10Y yield firmed above 1.55%

Crude futures remained sideways, within the $66.50 – $65.25 band, after reports of reduction in US crude supplies failed to offset market worries on potential new Iran supplies. Gold closed with bearish pin bar, below $1,900/oz, as lure of yields sent Dollar on firm bid.

In the FX space, Fed’s tapering talks spurred demand for King Dollar in the short to medium term, while sending Euro and Aussie to the back burner. Medium to long term accounts remained cautious as bids for Swiss continued with Kiwi and Loonie. Sterling and Yen were relatively unchanged across the board.

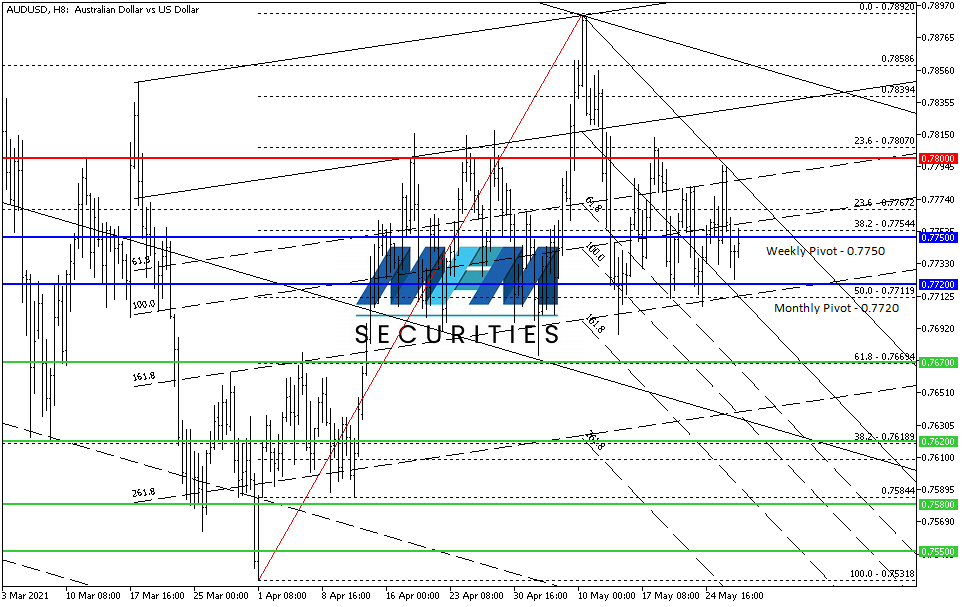

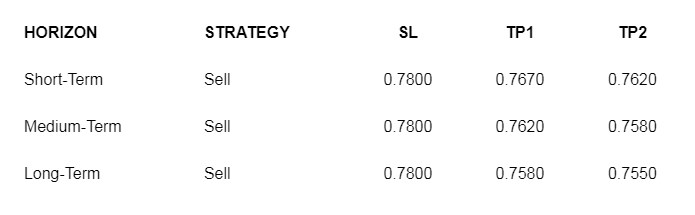

OUR PICK – AUD/USD

Yields flipped to favor USD. Short term bond yields have flipped to favor USD over AUD on Wednesday with 1Y notes registering 0.01% differential, 2Y for 0.08%, and 0.28% for 3 years. We see Aussie holders to shift to the Greenback and continue on bidding Loonie as these two currencies offer among the best yields in the G7 space. Sell on Rally.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.