Thin Markets On US & UK Holidays

MFMTeam

Publish date: Tue, 01 Jun 2021, 12:49 AM

STATE OF THE MARKETS

Thin markets on US & UK holidays. With the UK closed for Spring Bank Holiday and the US for Memorial day, markets have been thinly traded ahead of the RBA rate decision on Tuesday. Later this week, US non farm payroll will be on center stage where more jobs additions (650k vs 266k) and a lower unemployment (5.9% vs 6.1%) were expected which could see Dollar on firm bids.

Crude futures remained on upward momentum, above $67.50/bl, after reports showed that global oil demand could rebound to 100 million bpd, as summer travels gained traction in Europe and North America. Dealers bid gold higher, as speculators continue to pour offers, after Feds officials talk about taper saw the 10Y yields firmed above 1.60%. The yellow metal settled above $1,908/oz on Monday.

In the FX space, the holidays saw Dollar on offers as the Index (DXY) pulled back to 89.80, benefitting Aussie, Euro and Kiwi the most in the short term. Medium and long term investors seemed willing to take on risk, as the safe haven Yen and Swiss reverted to offers. Sterling and Loonie remained relatively unchanged across the board.

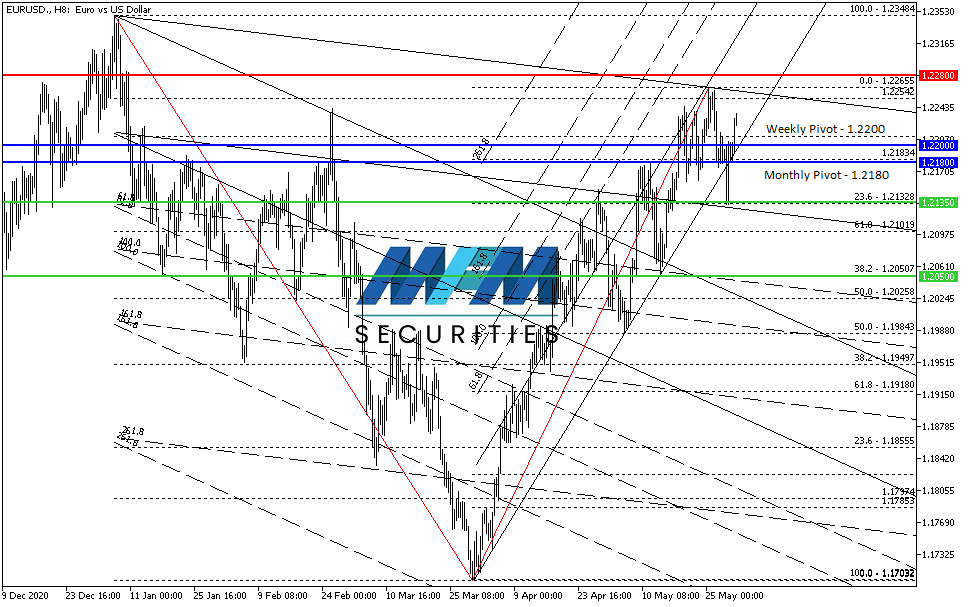

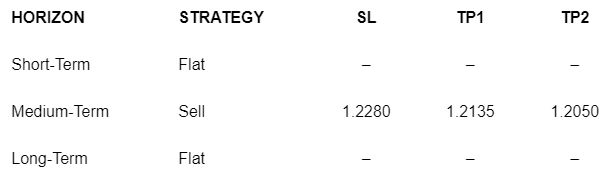

OUR PICK – EUR/USD

Light economic calendar may put the Euro on offer. With only German manufacturing PMI that is expected worst than before (64.0 vs 66.2) and rising inflation in Europe (1.9% vs 1.6%) to support Euro this week, we see Euro offers on the cards and imminent Dollar rebound, especially with ongoing Feds taper talks and better expectation on the US employment figures. With US yields definitely better than most European nations, we know the recent Euro rally was more of a Dollar weakness than Euro strength. We prefer to sell on rallies for the medium term.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.