Dollar In Limbo As Markets Await NFP

MFMTeam

Publish date: Thu, 03 Jun 2021, 09:53 AM

STATE OF THE MARKETS

Dollar in limbo as markets await NFP. Another day of pop and drop for the US equities markets on Wednesday as Dow (+0.07%), Nasdaq (+0.14%), S&P (+0.14%) and Russell (+0.13%) closed higher than the day before; after comments from Philly Fed President Patrick Harker that rates were going to stay low “for a long time”. More than $339 billion worth of block orders flowed into the US bond futures, forcing yields to edge lower. 10Y settled below 1.60% while 5Y at 0.80% as New York closed.

Crude futures continue to break higher, past $69/bl, after OPEC+ decided to continue its supply quota amid demand recovery from the US and China. Fed’s comment put gold back above $1,900/oz while Dollar lost bid after inflation concerns dampen demand for the Greenback.

In the FX space, surging crude prices sent Loonie to reign in demand while Sterling demand synching across all horizons. Short to medium term traders seemed on risk-off as Kiwi was sent to the back burner, while demanding for Swiss and Yen. Aussie and Dollar seemed to be taking a pullback, while Euro advanced in the demand territories. Long term remains relatively unchanged with the Dollar in limbo as markets await NFP this Friday.

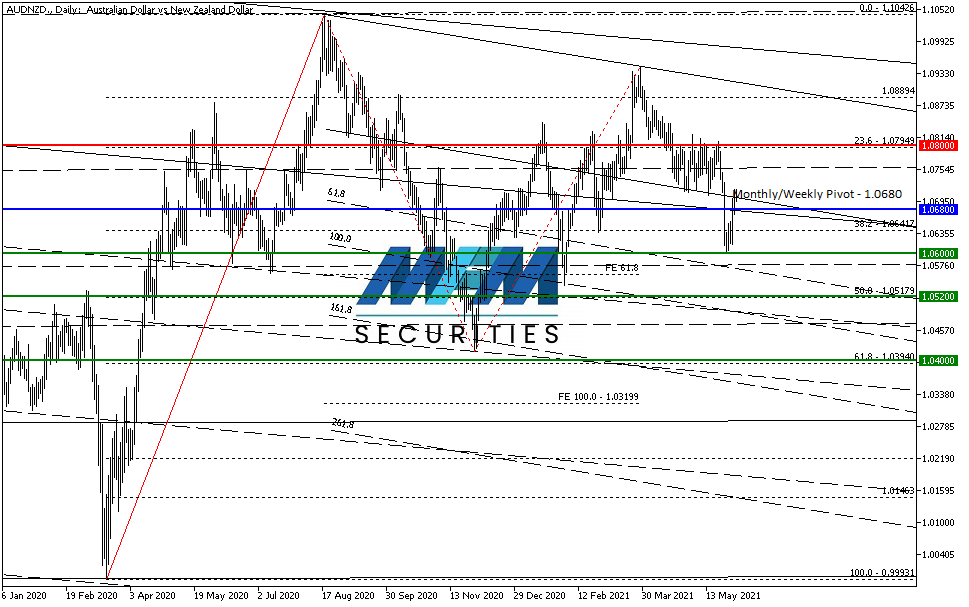

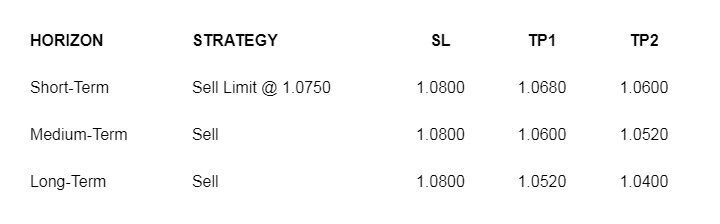

OUR PICK – AUD/NZD

Yields favored Kiwi over Aussie. The picture below shows a thousand words about why we think AUD/NZD will continue its downtrend in the next eight to ten weeks. Kiwi bonds are among the best yielding bonds in the G8 space next to Loonie. The Aussie is not that bad, but recent rate cuts have shifted demand to CAD and NZD. This pair, however, is a slow moving pair having an ATR (13) of 50 pips a day, 110 pips a week. So patience is needed to arrive at the destinations.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.