Stocks Rebounded On Dollar’s Pullback

MFMTeam

Publish date: Tue, 22 Jun 2021, 09:21 AM

STATE OF THE MARKETS

Stocks rebounded on Dollar’s pullback. US stocks rebounded sharply higher on Monday, after a tumultuous sell-off last week when Feds signaled earlier than expected rate hike. Smaller cap Russell (+2.16%) made the biggest gain while Dow (+1.76%), Nasdaq (+0.79%) and S&P (+1.40%) were also not falling behind, as Dollar (DXY) made a pullback to the 91.80 mark. The 10Y benchmark had a demand surge, forcing yields to drop to as low as 1.36% before settling around 1.50%.

Crude continues to receive dealer support, above $73/bl for the first time in 32 months, after Goldman Sachs continues to project $100/bl by year end. A pause in the Iran deal talks, after the new President, Ibrahim Raisi, took a hard stance on the deal; also gave crude some support. Gold received firm support, around $1,760/oz, as long term investors bid the metal to hedge against inflation.

King Dollar, Yen, Sterling and Euro dominated the demand territories in the medium and long term accounts as the comdolls and Swiss were offered. In the short-term term accounts, Sterling led demand with Loonie, Aussie and Kiwi; while Euro, Swiss, Dollar and Yen were offered.

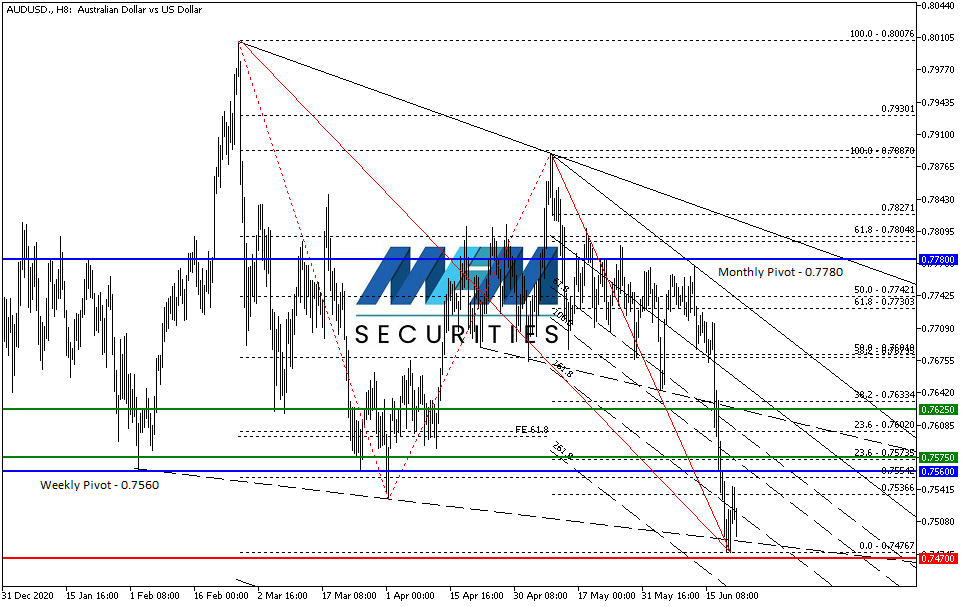

OUR PICK – AUD/USD

Trading on Dollar pullback. For the short-term, we might be seeing a Dollar (DXY) pullback to 91.50/20, and we pick AUD/USD for its resilience and positive correlation to gold. Medium to long term remains a sell in our view. This is a risky counter trend trade, and it might get stopped out before making its move to the upside.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.