Stocks Mixed Amid Safe Haven Flows

MFMTeam

Publish date: Tue, 29 Jun 2021, 09:21 AM

STATE OF THE MARKETS

Stocks mixed amid safe haven flows. US stocks closed mixed as investors ran to US treasuries and Dollars ahead of the US employment figures later this week. Though Nasdaq (+0.98%) and S&P (+0.23%) climbed to record territories, Dow (-0.44%) was lagging and lost bids. The benchmark US10Y bonds was on firmed bid, sending yields from the high of 1.53% to settled around 1.48% as New York closed after Dollar (DXY) was buoyed above 91.80 by risk averse bids.

Crude faced selling pressure ahead of the OPEC meeting this week, after new covid strains were reported in Asia and Europe, and Australia went back to lockdowns. The black gold settled around $72.90/bl as New York closed. Gold remained in a tight range of $1,788 and $1,770/oz as investors waited for US employment numbers this Friday, while the Dollar was on firm bid above the 91.80 mark.

Risk averse sentiments was evident in the FX space as Yen seized the helm of demand in the short term, while advancing further in demand for the long term accounts. Short term traders were seen less bullish as the comdolls were on offers, though they are favored by medium term traders. Euro was seen synching across horizons while Sterling lost appeal in the medium to long term accounts.

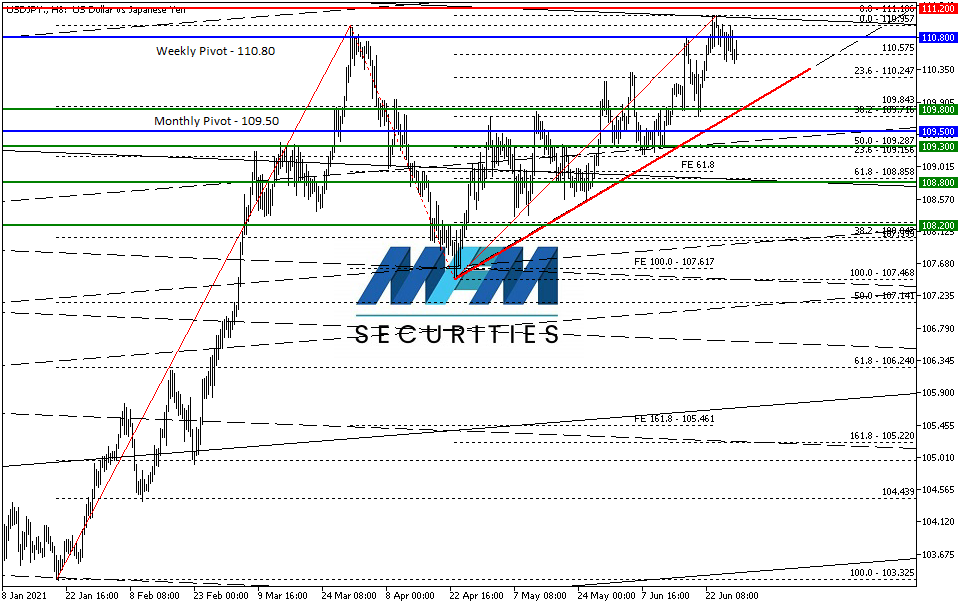

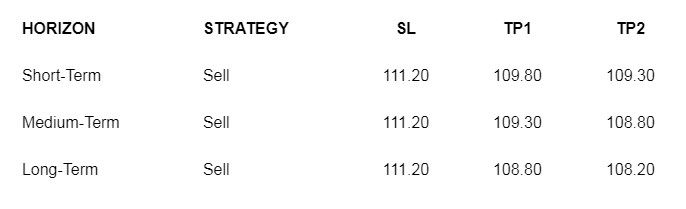

OUR PICK – USD/JPY

LT Risk turned sour even before FOMC. We have observed that long term risk has turned sour even before Fed’s meeting on the 16th. Our FX sentiments for safe haven Yen showed that Yen has garnered buying momentum since June 4th against the Aussie and June 8th against the Kiwi. We expect this momentum to continue into September as long as Fed’s recent dot plot of rate hikes remains unchanged. If this thesis is correct, then Dollar will remain supported and June’s high, circa ¥111.10, is most likely the top for USD/JPY. Confirming this thesis is the breakdown of the 30 degree trendline (colored in red). The only caveat we see is this is a negative swap for swing traders, unless your account is swaps free.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.