Dollar Buoyed Despite Falling Yields

MFMTeam

Publish date: Thu, 01 Jul 2021, 09:23 AM

STATE OF THE MARKETS

Dollar buoyed despite falling yields. As US stocks continue to climbed higher in the last week of Q2, with Dow (+0.61%) and Russell (+0.07%) finished in the green and Nasdaq (-0.17%) and S&P (+0.13%) in record territories; capital flows to the US bonds markets has increased, forcing yields of various maturities to decline to their lowest level of the quarter. It seems that markets don’t quite agree that the Fed’s rate hike is coming any time sooner than the end of the year. Dollar buying despite falling yields, signaled that markets are preparing for the worst.

In the commodities market, crude climbed higher after EIA reported that US crude supplies fell six weeks in a row and OPEC+ may have to lift production quota to support rising demand. The black gold settled around $73.50 as New York closed. Precious metal gold was firmly bid at the $1,750/oz level and closed at $1,769.80/oz in response to falling yields in the bonds market.

In the FX space, safe haven flows remained the theme for medium to long term accounts as Dollar and Yen led demand alongside Euro, Sterling, Loonie and Swiss as markets rebalanced itself on quarter end. Short term traders were seen more into selling Yen, Swiss and Euro while buying into Kiwi, Loonie and Dollar ahead of the NFP Friday.

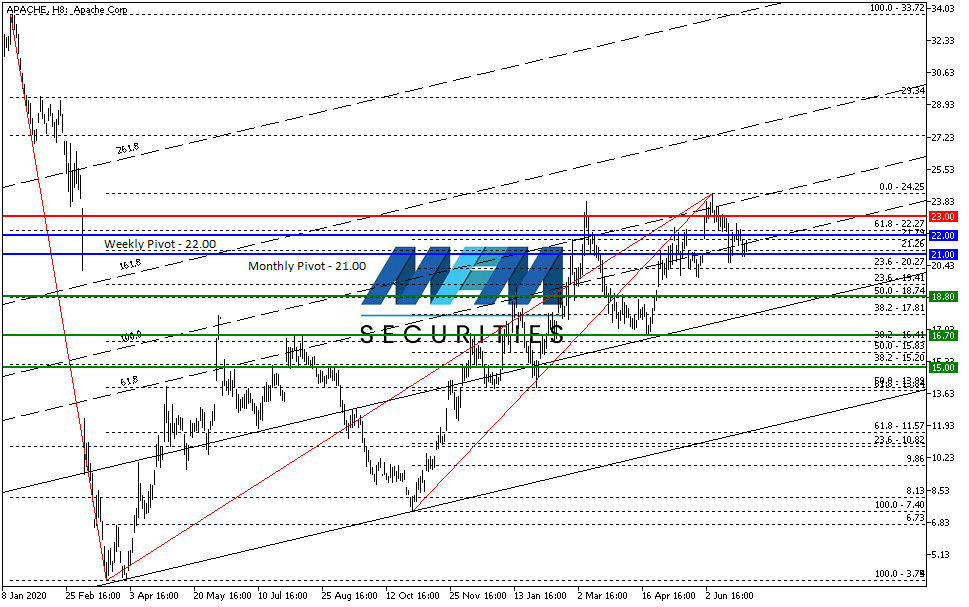

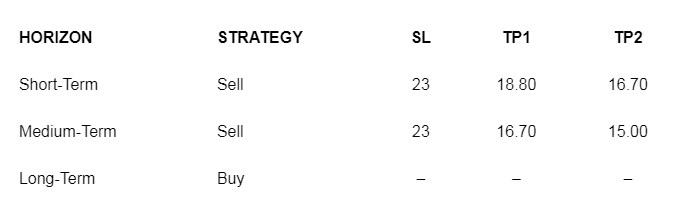

OUR PICK – Apache Corp (APA, NASDAQ)

Due for correction. After 10 weeks of travelling to its long term target, we see Apache is due for a short to medium term correction as long as $23 remains intact. S&P GMI sees around 23% correction to fair value, which means a target price of around $16.70, though we see further downside to $15/$14 is the best price to reverse short and re-enter long.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.