Equities Rally Post NFP

MFMTeam

Publish date: Tue, 06 Jul 2021, 09:25 AM

STATE OF THE MARKETS

Equities rally post NFP. With the US closed for holiday, global equities index from FTSE (+0.58%), Stoxx (+0.07%) to Nikkei (+0.27%) rallied on Monday post NFP that was not so strong to move the Feds. June NFP rose better (850k) than expected (680k) but unemployment rose 0.1% and hourly earnings dropped 0.1%; which subsequently pushed Dollar (DXY) below 92.50 mark and trending lower to the 92 handle as of this writing.

In the commodities market, crude advanced further past $76/bl after OPEC+ had a fall out between Saudi and UAE in deals to boost production. Similarly, gold continued its upward trajectory for the past three days to test the $1,800/oz mark as the Dollar weakened post NFP.

Dollar lost the reign of demand in the short and medium term to Kiwi, Aussie, Sterling, Yen, and Loonie, while still leading in the long term accounts. The Euro tried to rebound against the Dollar but lost ground against Sterling. Investors will be looking into PMI figures, jobs opening, unemployment and the FOMC minutes later this week to further decide the fate of King Dollar.

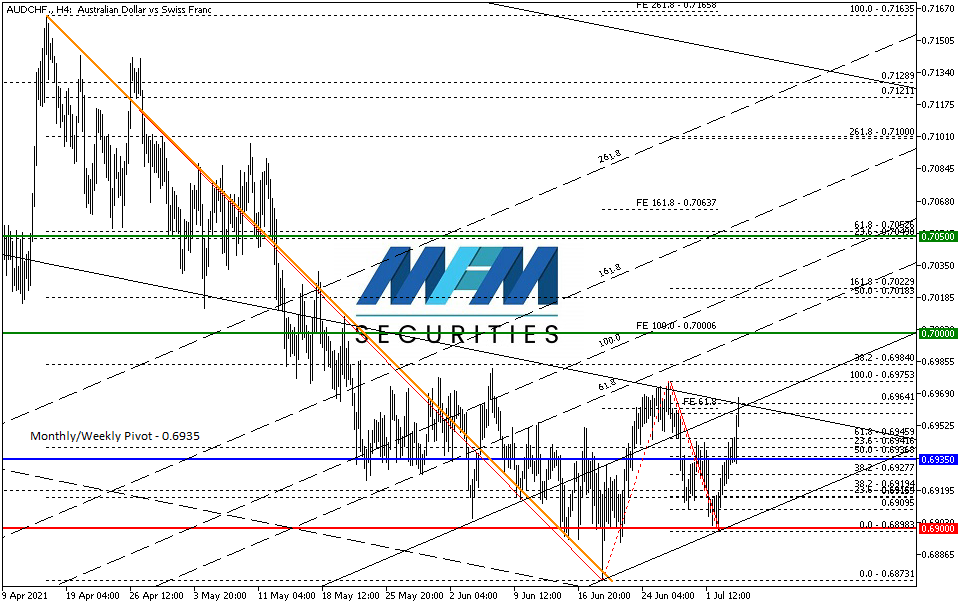

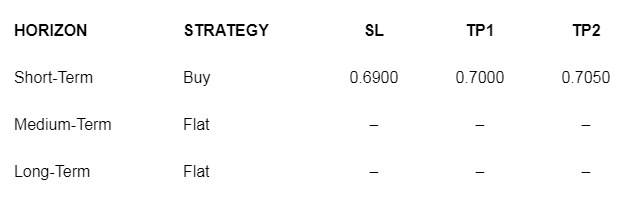

OUR PICK – AUD/CHF

Short term risk-on. Our FX Sentiments model showed a short-term shift in risk as traders trying to take advantage of weaker Dollar and rebound in high beta currencies. It’s not that often we see a convergence of a monthly and weekly pivot, and we saw it in AUD/CHF. Buy on dip as long as daily close above 0.6935 pivot.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.