Dollar Climbed Further Post NFP

MFMTeam

Publish date: Tue, 10 Aug 2021, 09:28 AM

STATE OF THE MARKETS

Dollar climbed further post NFP. While US stocks closed mixed on Monday, with Dow (-0.30%) and S&P (-0.09%) in the red and Nasdaq (+0.16%) in the green; Dollar climbed further to test the 93 handle after a strong jobs report on Friday. Gold “flash crash” on Monday stopped out many commodities traders, after yields moved higher with the 10Y benchmark breached 1.32% for the first time in four weeks.

In the commodities market, crude futures tumbled further as investors saw the rising delta variant covid cases might re-impose travel restrictions and threatened global economic growth. The black gold settled around $66.90/bl as New York closed. Stronger Dollar forced gold lower to $1,685/oz before bidders emerged to close the precious metal around $1,729.45/oz

In the FX space, King Dollar received a boost post NFP as markets expect tapering soon, though Yen and Kiwi dominated in the short and medium term accounts respectively. US inflation numbers will be on close watch as markets decide on the Dollar’s next move.

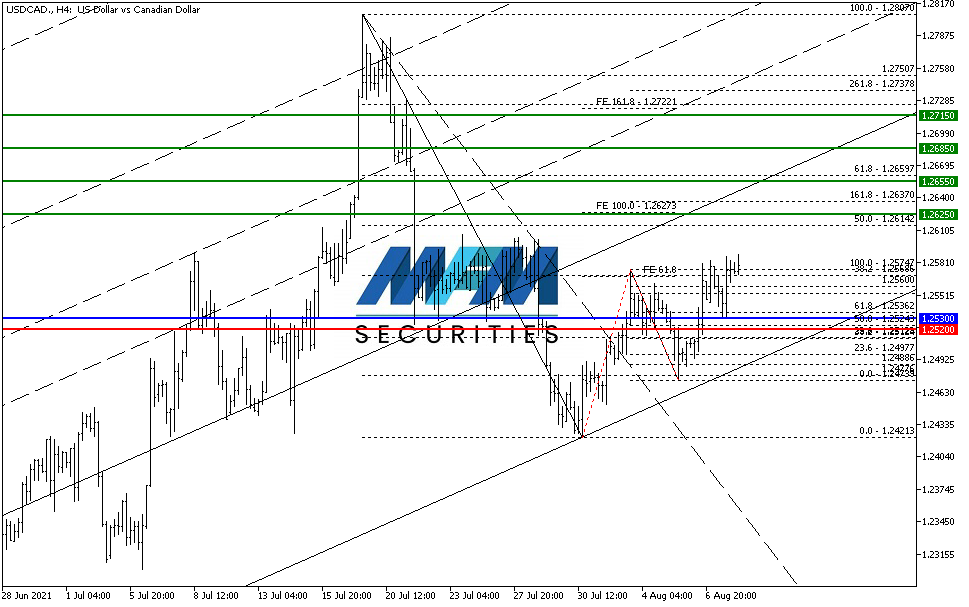

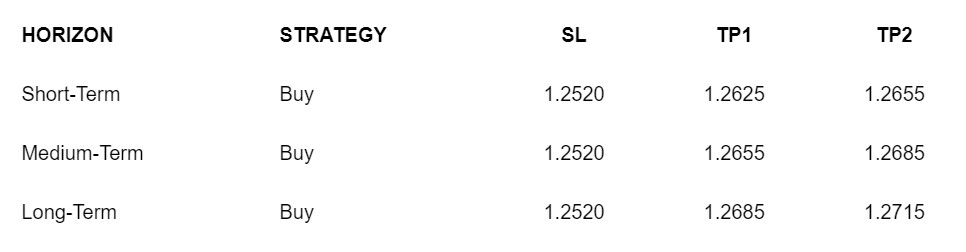

OUR PICK – USD/CAD

Crude weakness may fuel further Dollar rally. Crude weakness last week on rising cases of delta covid variant has helped Dollar gains on top of better employment figures that prompted speculation that Fed’s tapering is coming sooner than later. Inflation numbers this Wednesday are expected lower than previously (0.5% vs 0.9%) to prove that it’s transitory; in which case might prompt Fed’s to hold the horses. On the other hand, though BoC is looking hawkish, worse than expected Canadian employment numbers (94k added vs 177k expected and 230k previous) on Friday might actually see BoC stay put for a while.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.