Dollar Buoyed Amid Safe Haven Flows

MFMTeam

Publish date: Tue, 17 Aug 2021, 09:27 AM

STATE OF THE MARKETS

Dollar buoyed amid safe haven flows. As Dow (+0.31%) and S&P (+0.26%) broke record high on Monday, Nasdaq (-0.20%) and Russell (-0.89%) slid lower, after investors moved to defensive sectors in the wake of weak China data and US consumer sentiments last week. Dollar was buoyed by safe haven flows after news reported of Taliban victory in recapturing Kabul over the weekend. The 10Y yield fell to the low of 1.22% and more than $270 billion worth of block orders flowed into US treasuries futures as risk sentiments turned sour.

In the commodities market, crude futures continued to edge lower on Dollar strength and settled below $67.30/bl as New York closed. Gold, on the other hand, continues its upward trajectory toward $1,800/oz handle after markets do not see Fed’s tapering given weak consumer sentiments and easing inflation last week.

In the FX space, long term investors reverted to offering Dollar alongside Euro and Aussie, though more in demand for short and medium term accounts. Safe haven Swiss and Yen are dominating demand across all horizons as investors weigh the full impact of Taliban’s return in Afghanistan. Crude weakness is also weighing on Loonie for the short and medium term accounts. US retail sales and industrial production would be on close watch Tuesday.

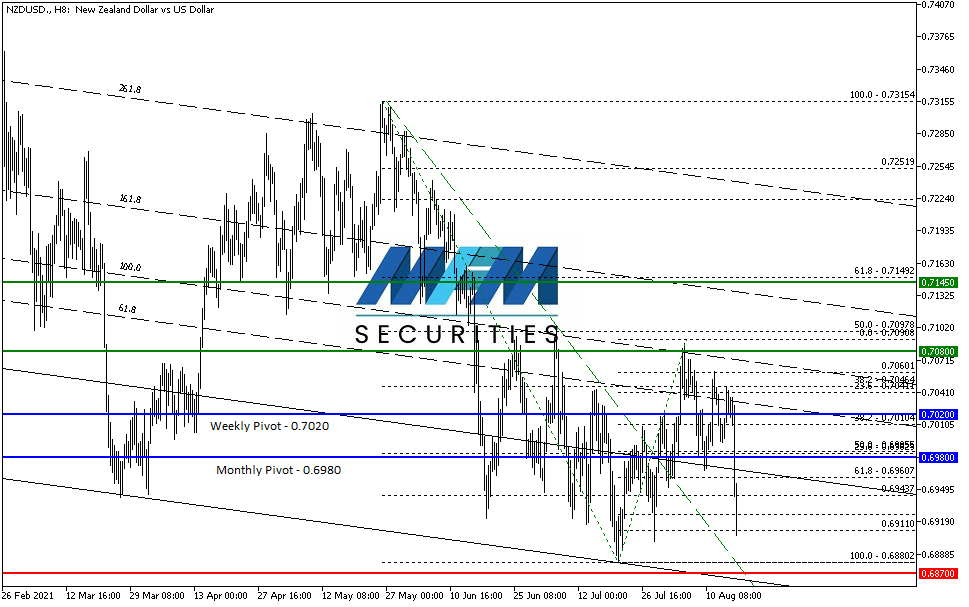

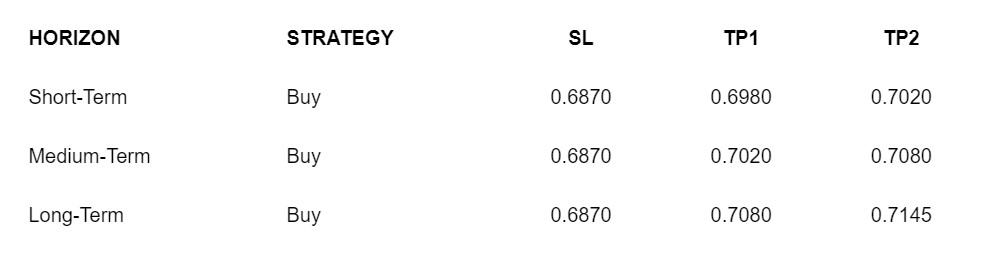

OUR PICK – NZD/USD

First rate hike from RBNZ. RBNZ is the first central bank expected to hike its rate this week as most other central banks stay put. Recent sell off was due to soured risk appetite and yields still favor Kiwi in the long haul.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.