Stocks In Red Amid Weaker Sales

MFMTeam

Publish date: Wed, 18 Aug 2021, 09:28 AM

STATE OF THE MARKETS

Stocks in red amid weaker sales. All major US indexes closed in the red, with Dow (-0.79%), S&P (-0.71%), and Nasdaq (-0.93%) including Russell (-1.19%) pared earlier gains, after reports showed that retail sales dropped (-1.1%) more than expected (-0.2%) and prior (0.7%). Dollar, however, continues to gain momentum from safe haven flows, closing back above the 93 handle as the 10Y yields firmed above 127 basis points.

In the commodities market, crude was in a tight range between $67.73 to $66.38/bl as buyers and sellers gauge the impact of rising cases in Asia and Americas versus OPEC supply concerns. Gold was in profit taking as it approached the $1,800/oz level and Dollar strength limited the upside in the precious metal.

In the FX space, King Dollar seized the helm of demand in the short term accounts, with safe haven Yen and Swiss as investors continue to assess the situation in Afghanistan. Long term investors seemed more optimistic as Loonie led the demand, while Swiss, Yen and Dollar were on a pullback. Sentiments in the medium term accounts remained relatively unchanged as investors waited for the FOMC minutes on Wednesday.

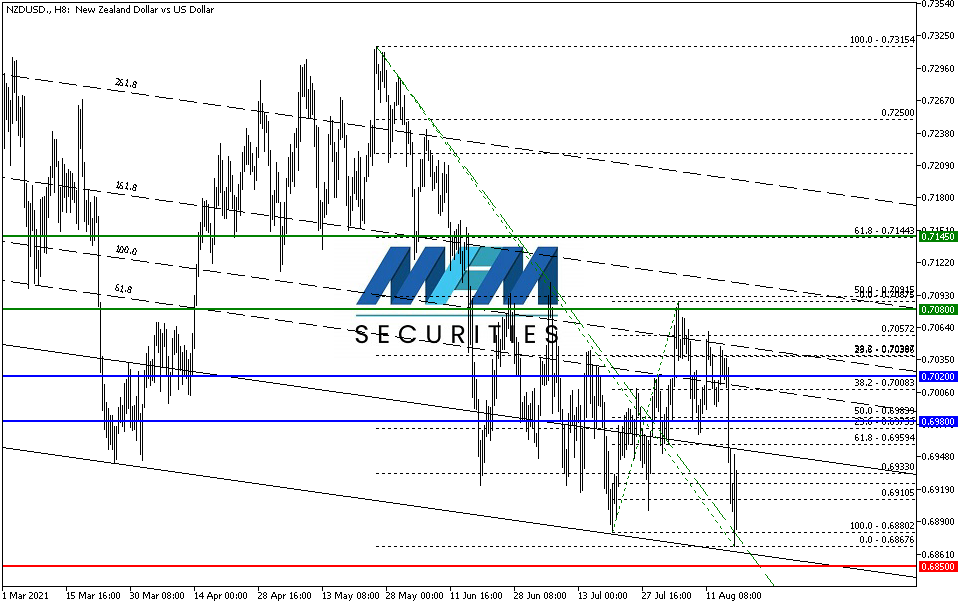

OUR PICK – NZD/USD, re-entry

No RBNZ hike, but yields still favor Kiwi. RBNZ surprised markets today as it decided to stay on hold at 25 basis points instead of 50 basis points expected, citing rising covid cases even though New Zealand had a strong CPI (3.3% vs 1.5%) and GDP (2.4% vs -0.8%), plus hot housing markets (82.6k vs 82.0k) and reduced unemployment (4.0% vs 4.7%). Strictly on yields, Kiwi remains favorable against Dollar in the long haul.

Disclaimer:

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.