NASDAQ Climbed Further Amid Falling Dollar

MFMTeam

Publish date: Thu, 02 Sep 2021, 09:41 AM

STATE OF THE MARKETS

NASDAQ climbed further amid falling Dollar. The tech heavy Nasdaq (+0.33%) advanced further on record territory, as S&P (+0.03%) and Dow (-0.14%) closed mixed on Wednesday; after ADP reports showed 374k jobs were added, far below the 625k expected. Dollar (DXY) continued to slide lower, remaining under pressure below the 92.50 minor handle as demand for Treasuries flip flop around the 1.30% yields for the 10Y benchmark.

In the commodities market, crude dipped to as low as $67.10/bl after OPEC+ stands firm on gradual output increase, but block bidders emerged around $67.60 to settle the black gold higher around $68.59/bl. Gold was trading in a tight range of $1,821.50 – $1,807.20/oz as investors await the employment reports Friday.

In the FX space, Aussie and Kiwi continue to dominate demand across all horizons as sentiments improve. Demand for Dollar in the short term accounts fell short, but medium and long term remains unchanged. Euro was seen synching across all horizons, and more so in demand for the long term accounts. US Jobless claims and productivity reports will be on close watch Thursday, ahead of NFP on Friday.

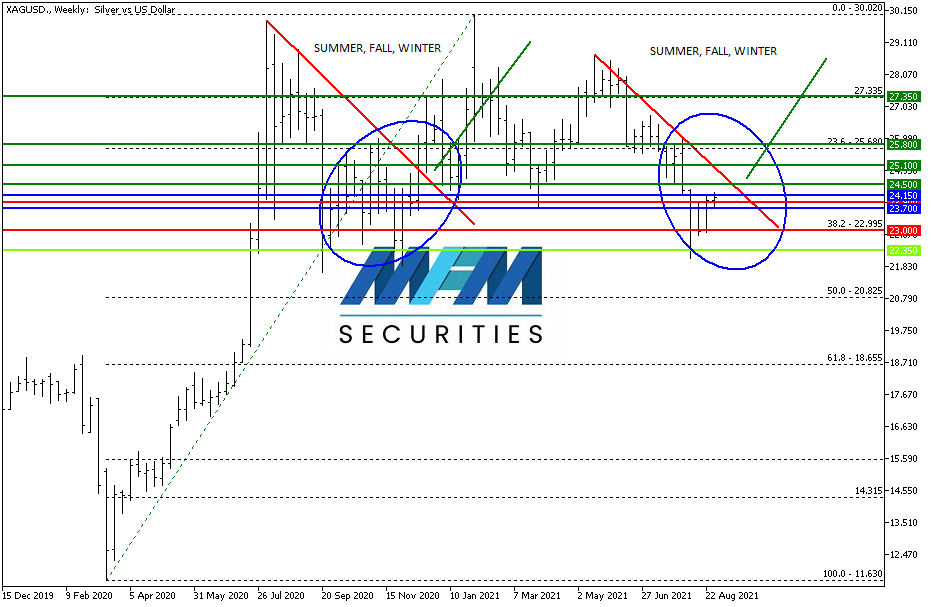

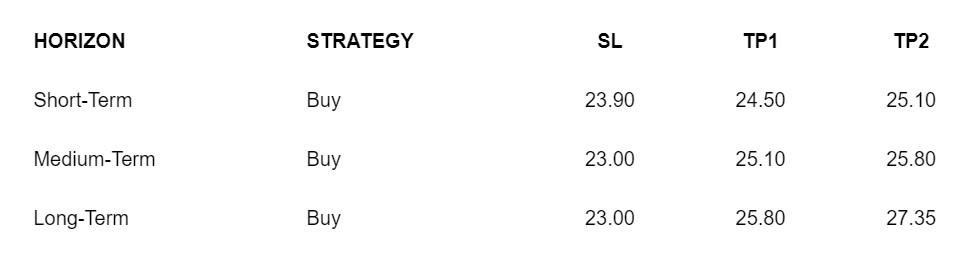

OUR PICK – XAG/USD

Declining supply. When silver sky rocketed last year, from the low of $11.25/oz in March to the high of $29.85/oz in August, that was because the prior year (2019) reported a declining surplus from 27.6m oz to 23.3m oz. Price then stabilized and stayed within the range of $30 to $20 in the futures market as the Silver Institute reported a surplus of 80.1m oz for 2020. With 2021 projected to revert back to the 2019 level of surplus, we expect silver to climb higher, to the top of the range. Risk remains, however, for the metal to flashed lower on Dollar strength as Fed’s narrative about tapering builds up.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.