Stocks Down As Optimism Fades

MFMTeam

Publish date: Thu, 09 Sep 2021, 09:29 AM

STATE OF THE MARKETS

Stocks down as optimism fades. US stocks snapped earlier gains, from Dow (-0.20%), Nasdaq (-0.57%) to S&P (-0.13%) with Russell (-1.14%) being the worst, after JOLTS reports showed that 10.9m jobs openings in August versus 10.1m expected. Though unemployment declined last week, jobs were not being filled fast enough to speed economic recovery as concerns on delta spreads run high. Yields tumbled as bond prices rose, with the 10Y benchmark falling back below 1.35% and the 5Y flirting around 0.80%.

In the commodities market, crude jumped to $69.75 before settling around $69.30/bl after reports showed that it will be months before gulf coast output could be restored after Hurricane Ida. Dollar strength sent gold lower for the past three days, settling around $1,788.93/oz as New York closed.

In the FX space, Yen and Kiwi ousted Dollar from the helm of demand in the short term as Sterling sent Euro to the back burner. In the medium term, King Dollar advanced to the demand territories with Yen while ousting Euro and Aussie to offers. Long term, however, saw the Dollar back on offer while Yen and Swiss were in demand as optimism faded. Jobless claims and EIA petroleum status report will be on watch Thursday, on top of ECB rate decision.

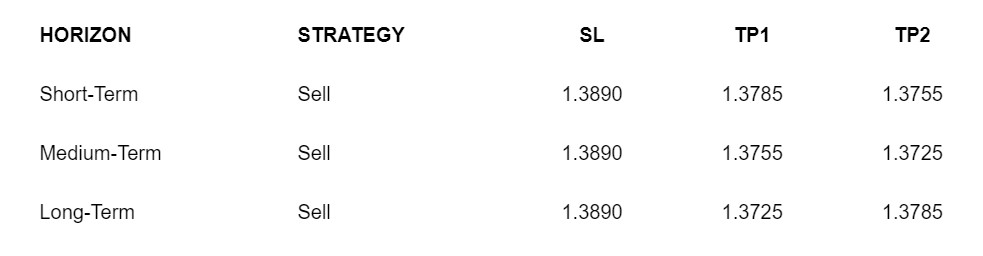

OUR PICK – GBP/USD.

Re-entering shorts. Previous shorts went as planned and we saw the rebound as mere profit taking from short term traders. Sentiments are bearish across all time horizons and candlestick patterns of Three Black Crow on the daily with bearish convergence momentum is a signal to short. With no clear signals in metals and energies, plus maximum exposure to equities, we revert to FX.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.