Stocks Slumped Ahead Of Earnings Season

MFMTeam

Publish date: Tue, 12 Oct 2021, 09:16 AM

STATE OF THE MARKETS

Stocks slumped ahead of earnings season. US stocks closed lower on Monday, after a downbeat NFP figure last Friday that saw the 10Y yields spiked to over 160 basis points. Major indexes from Dow (-0.72%) and S&P (-0.69%) to Nasdaq (-0.64%) and Russell (-0.56%) lost bids as investors prepared for Q3 earnings release that may reflect rising costs and supply chain issues. Dollar (DXY) was firmed above the 94 handle.

In the commodities market, crude continues to rally amid surging demand and OPEC+ reluctance to increase supply. The black gold spiked to as high as $82/bl before settling lower around $80.50. Gold remained stuck in the $1750-60 range, after spiked to as high as $1,782/oz after NFP release on Friday. Elsewhere, iron ore for December jumped above $133.80/tn (+14.7%) amid news that supply chain issues might be worse than expected after the Southwest meltdown.

In the FX space, Aussie, Dollar, Swiss and Euro were seen synching across short to medium term accounts as Yen was synching across all horizons. Long term sentiments seemed improved as Aussie overtook Swiss in demand, while Euro and Kiwi advanced as Yen was sent to the back burner. Markets look forward to seeing the jobs opening report ahead of CPI that is expected to stabilize on Wednesday.

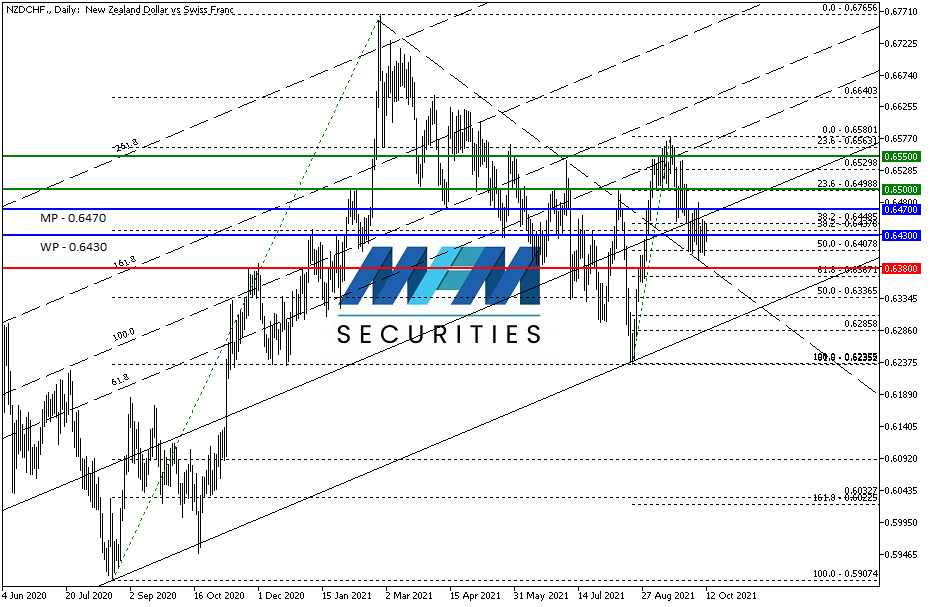

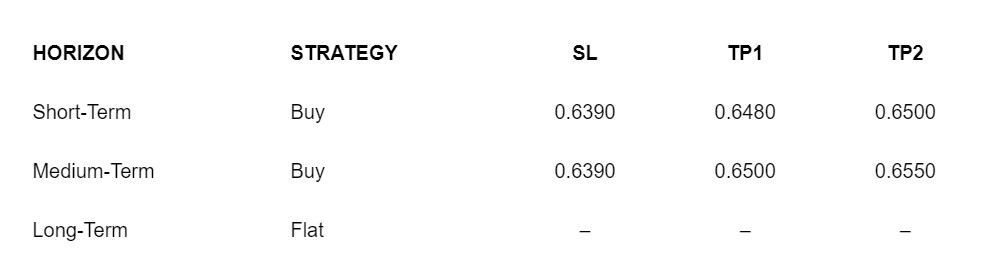

OUR PICK – NZD/CHF

Markets yet to reflect on RBNZ rate hike. When RBNZ raised its cash rate to 50 basis points Wednesday last week, many retail traders were caught off-guard when Kiwi plunged instead of rising. NZD offers the highest yields among G8 currencies at this point. We saw a flux of orders from low and negative yielders that may force dealers to bid Kiwi higher across the board. The caveat though, any change in risk sentiments might put the trade at immediate risk to test lower as medium to long term sentiments remain to the downside.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.