Equities Mixed Amid China Slowdown

MFMTeam

Publish date: Tue, 19 Oct 2021, 10:41 AM

STATE OF THE MARKETS

Equities mixed amid China slowdown. Global equities closed mixed on Monday after news hit the wires that China’s economy grew slower (4.9%) than expected (5.1%) and sharply lower (7.9%) than previous quarter. World indexes from Dow (-0.10%) and FTSE (-0.42%) edged lower, while Nikkei (+0.62%) and Shanghai (+0.76%) eked some gains in Asian trading on Tuesday. Dollar (DXY) wobbled below the 94 handle and trending lower at writing as yields eased. The 10Y benchmark settled below 160 basis points as New York closed.

In the commodities market, crude was firm above the $82/bl as major banks continue to see supplies deficit going into winter in the aftermath of gulf coast production shutdown. Gold was under pressure but remained well bid above $1,760/oz after a 1.7% decline on Friday on Dollar strength. Elsewhere, iron ore was firm above $123.40 on spot as investors await the US infrastructure bills to be passed next month.

In the FX space, sentiments continue to be bullish as long term investors flipped Dollar to Kiwi in the demand territories, while medium term accounts sent Swiss to offers. Demand for Loonie eased off in the short and medium term as players moved into Euro and Sterling. Markets look for more earnings reports on Tuesday, especially from Bank of New York Mellon (BK), Haliburton (HAL), Johnson & Johnson (JNJ), Lam Research (LRCX), United Airlines (UAL) and Netflix (NFLX) to name a few.

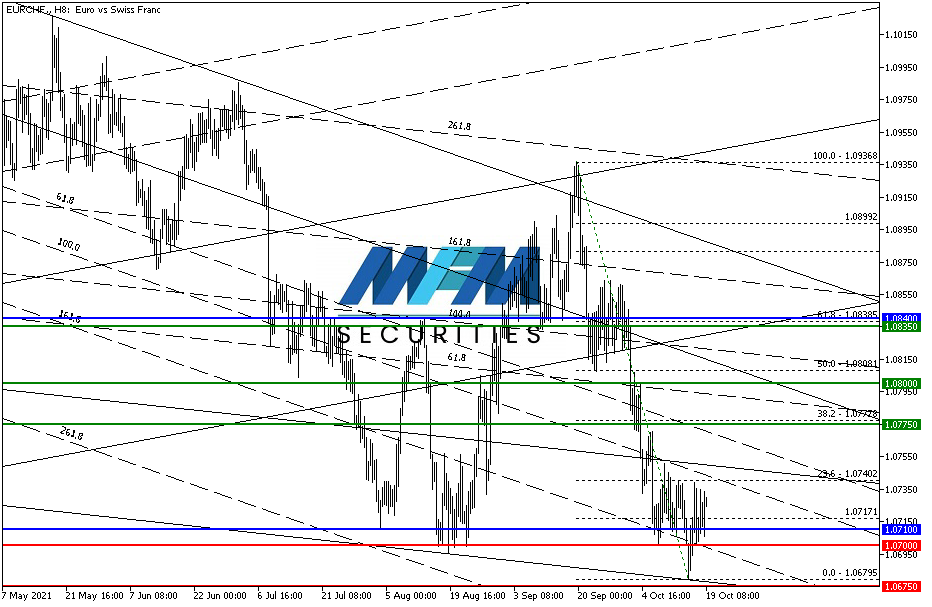

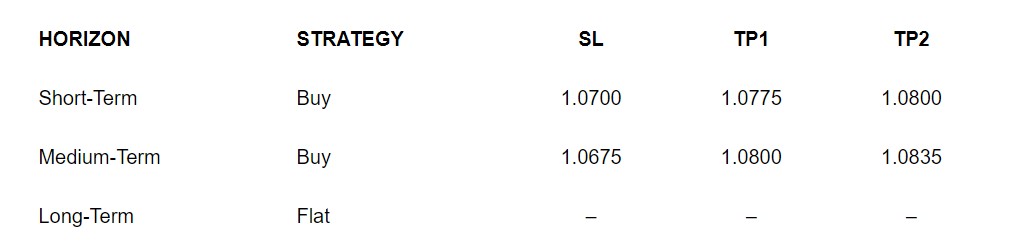

OUR PICK – EUR/CHF

Improved sentiments should bode well for the Euro. Fear of market meltdown from China’s Evergrande has subsided and now markets are back on track to regular rhythm. Slowdown in China’s economy did not deter the country from issuing $4 billion of new bonds that offer higher yields than the US Treasuries. Recent improved diplomatic relations between China and Europe should also augur well for the Euro in our view.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.