Stocks Mixed Amid Rising Yields

MFMTeam

Publish date: Fri, 22 Oct 2021, 09:21 AM

STATE OF THE MARKETS

Stocks mixed amid rising yields. US stocks closed mixed on Thursday, with S&P (+0.30%) punched a new record high and Nasdaq (+0.62%) climbed higher; while Dow (-0.02%) edged lower as bond sell-off triggered yields higher. The 10Y benchmark yielded 1.69% at writing while Dollar (DXY) traded lower circa 93.50 handle.

In the commodities market, crude rally fizzled as traders took profits off the table, sending the black gold lower to $83.50 as New York closed. Gold briefly paused at $1785 after selling pressure capped the yellow metal, but has climbed back to retest the $1,800/oz as of this writing. Iron ore traded lower, back to $121.15/tn, as the US infrastructure bills remain in limbo.

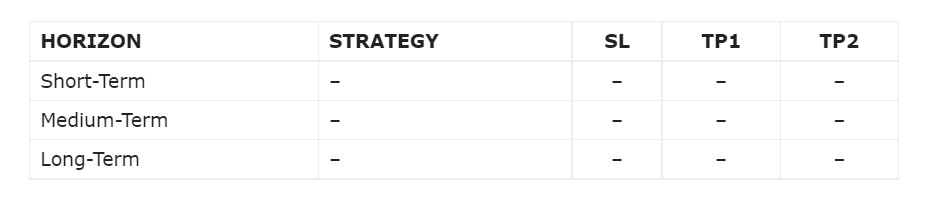

In the FX space, short term traders seemed to book profits off the table as Yen, Swiss and Dollar seized the helm of demand from the comdolls. Medium term accounts seemed more cautious as Swiss seized the demand from Loonie. Long term sentiments remain unchanged. Markets look for PMI composite and more earnings reports especially from American Express (AXP), Roper Technologies (ROP), VF Corp (VFC) and Schlumberger (SLB) to name a few.

OUR PICK – No New Pick.

No new pick going into the weekend. Outflow from the US equities has become a new norm and this week is no different. About $1.3b flowed out of the domestic equities and about $530 million was channeled to foreign equities. Prior funds parked at short term money markets, about $7.9b, have moved to bond funds. As inflation concerns remain, investors seem to be jumping back to commodities like precious metals and higher yielding currencies. We see Dollar (DXY) trending lower to the 93 handle unless fresh buying comes in sooner than later. Have a wonderful weekend!

Trades updates:

Equities: Currently we are holding 8 stocks – 7 longs and 1 short. We are long AUY (20% undervalued) with dividends yielding 2.78%, T (18% undervalued) at 8.03% yields and COG (CTRA) (14% undervalued) yielding 2.06%. CLVS is currently 21% overvalued with -7.19 z-score but Tudor Investment had stepped in recently and we decided to hold. We remain bullish with VIPS (43% undervalued with 5.59 z-score), GT (47% undervalued with 1.28 z-score) and CRON (18% undervalued with 9.18 z-score) while bearish GE (26% overvalued with 1.36 z-score).

FX & Commodities: NZD/CHF has completed all targets and AUD/CAD has completed short term targets. EUR/CHF didn’t quite work as planned, but we believe the bottom is in place. Gold (XAU/USD) remains active.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.