Stocks Under Pressure Amid Economic Uncertainties

MFMTeam

Publish date: Thu, 18 Nov 2021, 08:25 AM

STATE OF THE MARKETS

Stocks under pressure amid economic uncertainties. US stocks closed lower on Wednesday, with Dow (-0.60%), Nasdaq (-0.30%) and S&P (-0.30%) pared earlier gains after reports showed weaker than expected housing data, a sign that the US economy might be facing headwinds ahead. Flights to safety were noted with yields and Dollar under pressure, as the 10Y benchmark slid below 160 basis points and Dollar index formed a bearish pin bar.

In the commodities market, crude fell further to $78.40/bl after President Biden instructed FTC to further examine the oil and gas markets. Gold was under firmed bids, back above $1,865/oz, as Feds might be having a new dove on board. Elsewhere, iron ore moved higher to $92.80/tn mark as the US infrastructure bills close to signature.

In the FX space, Yen advanced further in the demand territories as short and medium term traders continue to hedge their Dollar positions, while Sterling continues to lead. Loonie pared earlier gains as the Aussie and Kiwi struggled to find bids. Long term sentiments turned bearish as Swiss flipped to demand. On Thursday markets look for earnings reports from Alibaba (BABA), Applied Materials (AMAT), Cisco (CSCO), JD.com (JD) and Workday (WDAY); on top of jobless claims and leading indicators.

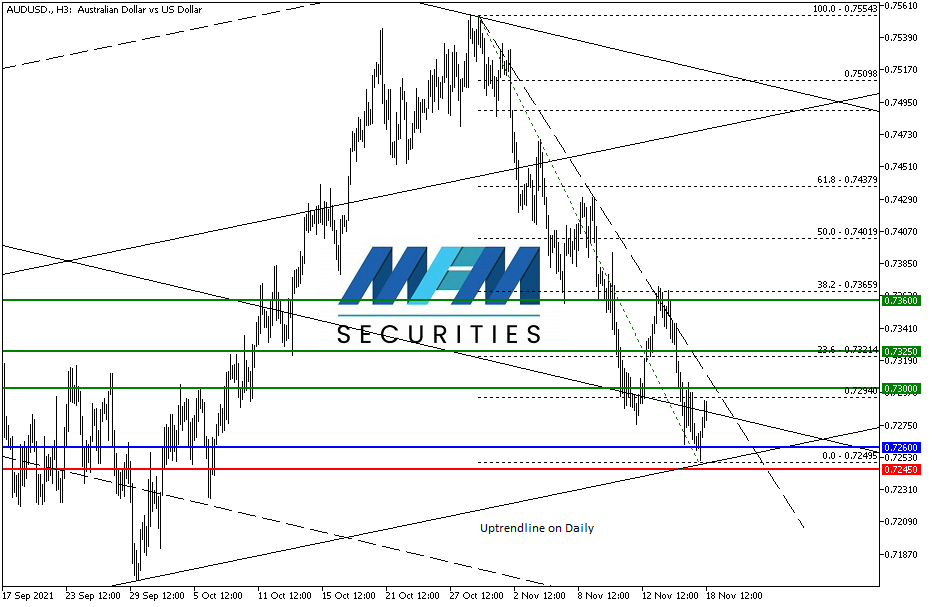

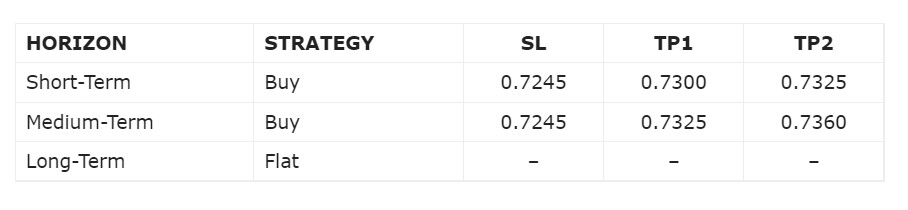

OUR PICK – AUD/USD

Turning around on the daily uptrend line. Technically, Aussie is at a juncture of the daily uptrend line and we expect a turnaround if 0.7250 holds. A short term play, yes, but with headwinds facing US Dollar in the wake of new economic data and potentially a change in Feds chairman to a dove, might put Dollar rise at bay and a medium term rally in Aussie.

Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.