Stocks Battered Amid Risk-Off

MFMTeam

Publish date: Tue, 21 Dec 2021, 08:17 AM

STATE OF THE MARKETS

Stocks battered amid risk-off. US stocks continue to plunge on Monday as markets digested further on Fed’s tapering and rate hike in 2022. Rising cases of Omicron globally was not helping as the dive was across the board. Dow (-1.23%), Nasdaq (-1.24%), S&P (-1.14%) and Russell (-1.57%) were pulled down with technology, real estate and communication services being the weakest sectors. Cash demand with bonds sell-off sent yields lower with the 10Y spiked back to 1.43% while Dollar sustained above 96.50 minor handle.

In the commodities market, risk-off on Omicron concerns sent crude lower, close to $66/bl before bidders emerged and settled the black gold at $69.10 as New York closed. Gold was fixed lower at $1,790.50/oz on Dollar strength but remained well bid together with iron ore that continued to climb past $113.70/tn as commodities markets positioned for inflation trades next year.

In the FX space, risk-off was evident as Swiss led the demand in short and medium term accounts with Euro, Dollar and Yen. Long term sentiments back to bearish as Yen seized the helm of demand from King Dollar. On Tuesday, markets look for earnings reports from General Mills (GIS), Factset Research (FDS), BlackBerry (BB), Neogen (NEOG) and Enerpac (EPAC). Oil traders look forward to reading the reports on API crude stock change.

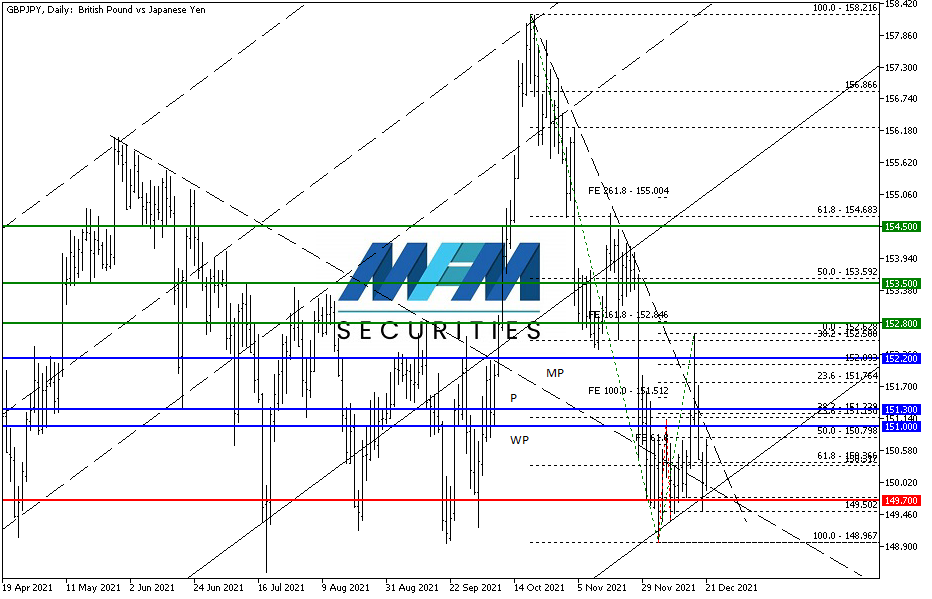

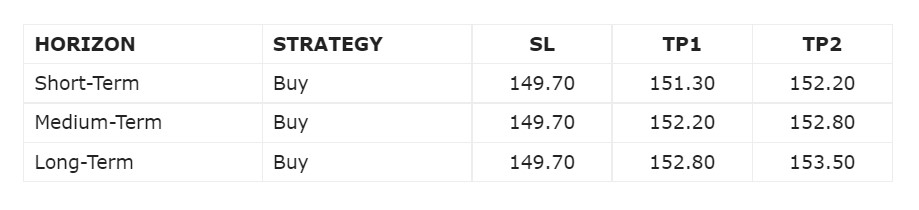

OUR PICK – GBP/JPY

Re-entry with adjusted stop and targets. We wrote “We see further rebound to as far as ¥155 if the exchange rate closes above ¥151.30 on the weekly chart. The pair is pulling back at writing and any extended losses below ¥150 will negate this bullish scenario, however.” The pair took our stop as it dived to ¥149.50 but closed above ¥150 on Monday while closed at ¥150.40 last week. We see re-entry as the bullish scenario remains in play.

Risk Disclaimer:

This article is for general information purpose only. It is not an investment advice or a solicitation to buy or sell any securities/oz. Opinions expressed are of the authors and not necessarily of MFM Securities Limited or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.